Introduction

Every year, thousands of investors lose access to their hard-earned money because they forget to claim dividends, ignore company notices, or misplace their old physical share certificates. As a result, crores worth of unclaimed dividends, matured deposits, and shares remain untouched for years. To solve this growing problem, the Government of India created a special authority—IEPF.

In this 2025 complete guide, we will explain what is IEPF, why it was formed, how shares end up there, and the exact step-by-step process to claim your money or shares back. This blog is designed to be practical, updated, and easy to understand.

1. What is IEPF? (Full Meaning Explained)

The term IEPF stands for Investor Education and Protection Fund. It is a government-created fund established under the Companies Act, 2013, and managed by the IEPF Authority, a statutory body under the Ministry of Corporate Affairs (MCA). If you are wondering what is IEPF, it is essentially a government authority where unclaimed dividends, shares, deposits, and debentures are transferred after 7 years of inactivity.

In simple words, IEPF acts as a secure vault for unclaimed financial assets, ensuring that no company can misuse investor funds. Investors or their legal heirs can reclaim these amounts by filing an official application through the IEPF claim process.

2. Why Was IEPF Created? (Purpose & Need)

The primary purpose of IEPF is to protect investors and ensure transparency. Over the decades, many companies held unclaimed dividends or deposits without an organized tracking system. This led to:

- Loss of investor wealth

- Mismanagement of funds

- Difficulty for families to recover old investments

- Lack of awareness about unclaimed shares

To address these issues, the IEPF Authority was established.

Key Purposes of IEPF

2.1 Safeguard Unclaimed Investor Money

If a dividend, deposit, or share remains unclaimed for 7 consecutive years, companies must transfer it to IEPF. This ensures money doesn’t remain idle or get misused.

2.2 Protect Investor Rights

IEPF ensures companies treat investors fairly and maintain accurate records.

2.3 Promote Investor Education

A portion of IEPF funds is used to create educational programs on financial literacy and safe investing.

2.4 Provide a Simple Claim Mechanism

Instead of contacting multiple companies, investors can reclaim money through one centralized portal.

Transparency and Accessibility:

Once you know what is IEPF, you’ll find that the claim process is conducted through an online portal, making it easier and more transparent for users.

Investor Education:

Beyond just helping with unclaimed assets, what is IEPF also extends to promoting financial literacy by conducting workshops and awareness campaigns across the country.

3. What Funds and Shares Are Transferred to IEPF?

Under the law, the following unclaimed assets must be transferred to IEPF after 7 years:

3.1 Unclaimed Dividends

If you do not claim dividends for 7 consecutive years, the amount is moved to IEPF.

3.2 Shares Associated With Unclaimed Dividends

If dividends remain unclaimed for seven years, your shares are also transferred to IEPF’s Demat account.

3.3 Matured Fixed Deposits and Debentures

Any matured deposit/debenture not claimed by the investor goes to IEPF.

3.4 Application Money for Refunds

Unclaimed IPO or FPO refunds must be transferred.

3.5 Redemption Amounts

Unpaid redemption amounts for preference shares, debentures, etc.

3.6 Interest & Sale Proceeds Related to These Assets

IEPF receives all connected financial benefits.

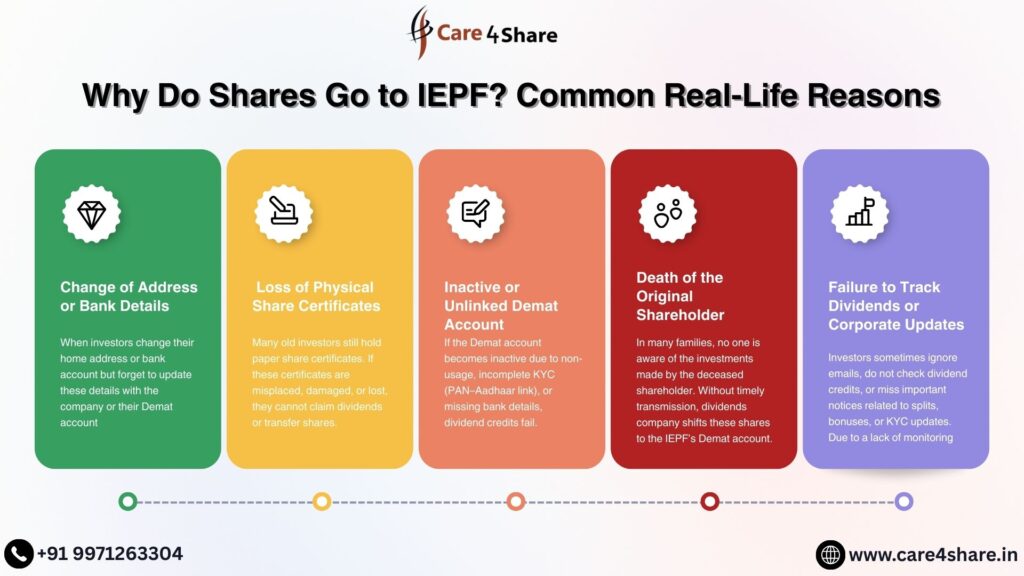

4. Why Do Shares Go to IEPF? Common Real-Life Reasons

Many investors are shocked to discover their shares have vanished from their Demat or physical certificates. Here’s why it happens:

4.1 Not Claiming Dividends on Time

If you miss 7 years of dividends, the corresponding shares are taken by IEPF.

4.2 Not Updating KYC

Change in:

- Address

- Phone number

- Bank account

If these are outdated, dividend credits fail and become unclaimed.

4.3 Physical Shares Not Converted to Demat

Many old physical certificates are lost, damaged, or forgotten.

4.4 Investor Has Passed Away

Family members often remain unaware of the investments.

4.5 Inactive Trading or Demat Account

Dormant accounts lead to communication gaps.

4.6 PAN/Aadhaar Mismatch

This can block dividend payouts.

4.7 Ignoring Company Notices

Companies send reminders, but many investors don’t respond.

5. How to Check Whether Your Shares or Dividends Are in IEPF

To check if any of your assets are with IEPF:

Step-by-Step Checking Method

- Visit the official IEPF website.

- Go to “Search Unclaimed Amounts / Shares”.

- Enter:

- Investor name

- Company name

- Father’s name

- Financial year

- View available records.

This search is free and works for all companies.

6. IEPF Claim Process Explained (2025 Updated Step-by-Step Guide)

Many investors think reclaiming shares is difficult, but the process is quite systematic. Here’s the complete breakdown:

Step 1: Verify Your Unclaimed Amount/Share Online

Confirm whether your assets are transferred to IEPF by using the search tool on the IEPF website.

Step 2: Fill Out the IEPF Claim Form (Form IEPF-5)

This form is available on the IEPF portal.

You must enter:

- Personal information

- Company details

- Number of shares or dividend amount

- Demat account details

- Bank account details

- PAN & Aadhaar information

After submitting, download:

- IEPF-5 Form

- Acknowledgment receipt

Step 3: Send the Necessary Documents to the Company

Print the completed IEPF-5 Form and attach all required documents.

Send them to the Nodal Officer of the respective company.

Mandatory Documents Include:

- Self-attested PAN & Aadhaar

- Original share certificates (if physical)

- CML (Client Master List from Demat account)

- Cancelled cheque

- Indemnity bond

- Passport-size photo

- IEPF-5 acknowledgment

For Legal Heirs:

- Death certificate of the shareholder

- Succession certificate / Legal heir certificate

- Signature verification certificate

- Probate (if applicable)

Step 4: Company Verification

The company verifies your documents and sends a report to IEPF Authority within 30 days.

Step 5: IEPF Authority Approves Your Claim

After the company confirms, IEPF reviews everything and approves or rejects the claim.

Timeline: 60 days

Once approved:

- Shares are credited to your Demat account

- Dividends and refunds are transferred to your bank account

7. How Long Does It Take to Get Your Shares Back?

The entire process takes approximately:

- Company Verification: 30 days

- IEPF Approval: 60 days

- Total: 90–120 days

For legal heir claims (succession cases), it may take longer due to documentation.

8. Documents Required for IEPF Claim (Complete Checklist 2025)

A. For Original Shareholder

- IEPF-5 Form & Acknowledgment

- PAN card (self-attested)

- Aadhaar card (self-attested)

- Cancelled cheque

- Client Master List (CML)

- Original share certificates (for physical shares)

- Dividend warrants (if available)

- Indemnity bond

B. For Legal Heir / Nominee

- Death certificate of shareholder

- Legal heir certificate / Succession certificate / Will

- PAN & Aadhaar

- Specimen signature certificate

- Probate documents (if needed)

- Relationship proof

- Legal heir certificate / Succession certificate

- certificate of no objection (NOC) from more legal heirs, if any

- Proof of relationship

- Probate of will (if available)

Important: Legal heirs must complete transmission of shares in their name before applying to the IEPF Authority.

9. How to Avoid Your Shares Going to IEPF (Must-Follow Tips)

Use these simple steps to ensure you don’t lose assets to IEPF:

9.1 Keep KYC Updated

Update your:

- Phone number

- Address

- Bank details

- PAN–Aadhaar link

9.2 Convert Physical Shares to Demat

Physical certificates are risky and often get lost.

9.3 Add Nominee to Your Demat Account

This ensures your family can claim assets easily.

9.4 Track Dividends Regularly

Check your bank and Demat statements monthly.

9.5 Inform Family About Investments

Most IEPF cases happen because families are unaware.

9.6 Avoid Dormant Demat Accounts

Use your account regularly.

10. Why IEPF Is Good for Investors (Benefits)

10.1 Prevents Loss of Wealth

Even if you forget your investment, it remains safe.

10.2 Fully Transparent Process

Everything is recorded digitally.

10.3 Family Can Recover Investments

Legal heirs can claim shares even decades later.

10.4 Educates and Protects Investors

IEPF conducts awareness campaigns nationwide.

11. About Care4Share

At Care4Share, our mission is to simplify finance and help investors safeguard their money. Through detailed guides like this, we ensure you understand what is IEPF, how it works, and how you can easily reclaim your unclaimed shares and dividends.

Conclusion: IEPF Ensures Your Money Is Never Lost

Now you clearly understand what is IEPF, why it exists, and how you can reclaim shares or dividends transferred to the fund. IEPF is not a dead end—it’s a safety net that protects your long-lost investments.

Whether you are a shareholder or a legal heir, you can easily recover your assets with proper documentation and the right process. In 2025, digital filing has made the entire experience much faster, smoother, and more transparent.

Your money is yours—now you know exactly how to get it back.