INTRO

In India, unclaimed dividends and shares make up an important portion of dormant investor wealth.. Every year, millions of rupees in corporate dividends remain unpaid because investors either forget about them, overlook keeping their bank information up to date, or stop communicating with the businesses they invested in. Left unchecked, these funds could be lost forever. The Ministry of Corporate Affairs (MCA) is of importance in this situation. Under the Companies Act, 2013, MCA regulates how companies handle unclaimed shares and dividends, ensuring that investor money is protected and recoverable through the Investor Education and Protection Fund (IEPF).

In this blog, we will explore:

What are unclaimed shares and dividends?

How the MCA regulates them under the Companies Act.

The role of IEPF in safekeeping and recovery.

The process for shareholders to reclaim their investments.

Common challenges and MCA’s interventions.

Best practices for investors to avoid unclaimed situations.

Future improvements MCA is working on.

1. Understanding Unclaimed Shares and Dividends

Unclaimed dividends arise when a company declares a dividend, but the shareholder does not claim it within the prescribed time frame. Reasons can include:

Change of address without informing the company.

Outdated bank account details.

Death of the shareholder without informing legal heirs.

Lost or misplaced physical dividend warrants.

In line with Section 124(6) of the Companies Act of 2013, related shares must be transferred to the IEPF if payments are not claimed for seven consecutive years.

For example:

The company will transfer the 500 shares and the unclaimed dividend amount to the IEPF’s demat account if you own 500 shares of the company and do not claim dividends on them for a total of seven years.

2. MCA’s Regulatory Framework

The Ministry of Corporate Affairs (MCA) is responsible for enforcing the Companies Act and ensuring companies comply with unclaimed dividend and share rules. Key provisions include:

124(6): All shares that have not received a dividend claim are also transferred.

- b) IEPF Rules, 2016

These rules detail procedures for companies to identify, disclose, and transfer unclaimed amounts to the IEPF.

- c) Mandatory Disclosures

Companies must publish details of unclaimed dividends on their websites and in annual reports, making them accessible to investors and heirs.

- d) Penalties for Non-Compliance

If a company fails to transfer unclaimed amounts to IEPF, MCA can impose fines and take legal action against directors.

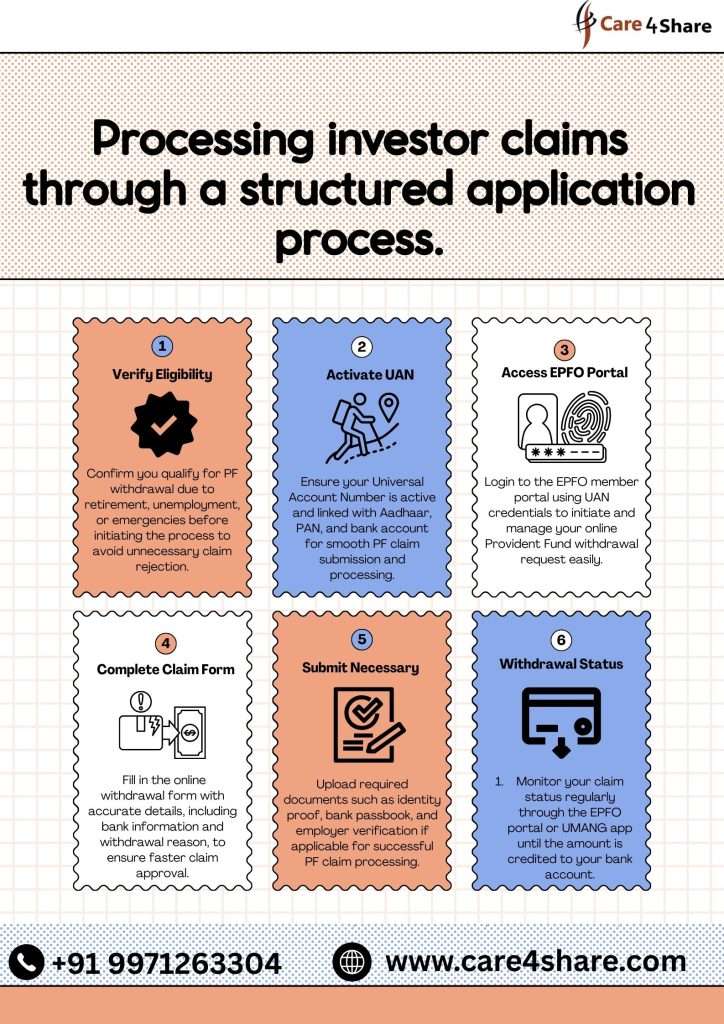

3. Processing investor claims through a structured application process.

MCA is in charge of the Investor Education and Protection Fund (IEPF) Authority. Among its functions are:

Holding unclaimed funds and shares securely.

Processing investor claims through a structured application process.

promoting investor education in an effort to lower the quantity of cases that go unclaimed.

publishing yearly reports on the amount and worth of assets that have not been claimed.

4. The Claim Process Under MCA Regulations

MCA ensures a standardized process for recovery:

Search for your unclaimed assets on the IEPF portal.

File IEPF Form-5 online.

Submit physical documents (PAN, Aadhaar, proof of ownership, succession proof if applicable) to the company’s nodal officer.

Once verified, the company submits the claim to IEPF.

After reviewing and approving the claim, IEPF returns shares or dividends to the investor’s bank account or demat.

This process is designed for transparency and traceability, reducing fraud risk.

5. Challenges in the Current System

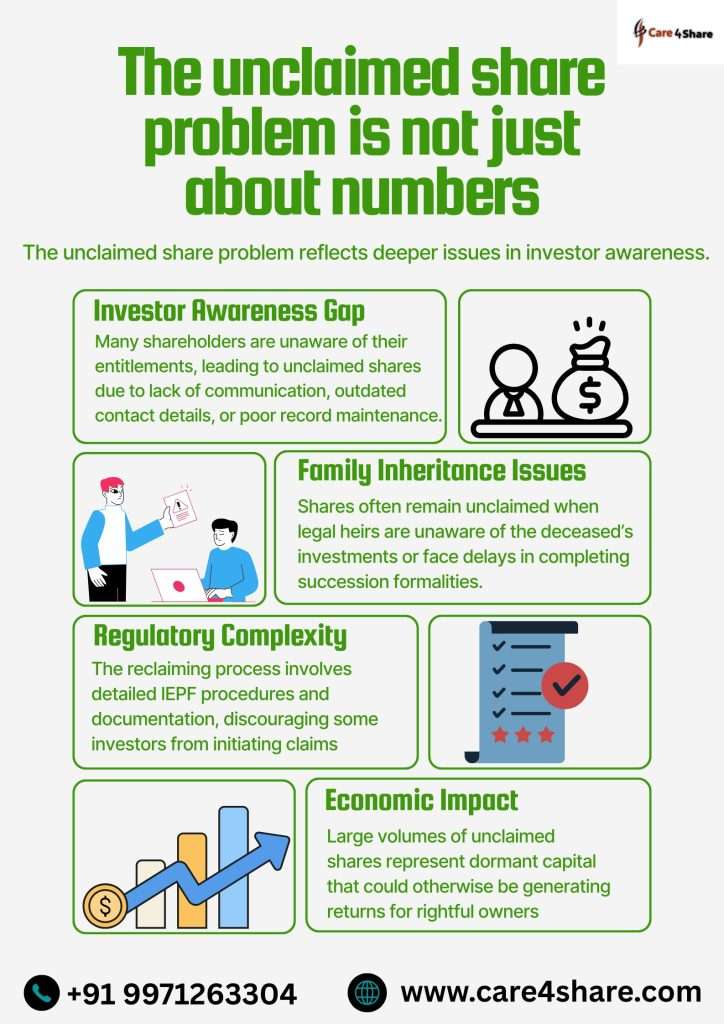

Despite MCA’s robust rules, investors face:

Long processing times — claims can take months to approve.

Documentation hurdles — especially for legal heirs.

Lack of awareness — many investors don’t even know their assets are unclaimed.

Agent exploitation — some middlemen charge high fees to assist with claims.

MCA has responded by:

Simplifying online forms.

Mandating that companies proactively contact investors before transfers.

Running investor awareness campaigns.

6. Best Practices for Investors

To avoid losing access to dividends and shares:

Keep bank and address details updated with companies and depositories.

Convert physical shares to demat form.

Monitor corporate announcements and dividend payments.

Nominate a family member for all investments.

Check the IEPF portal annually for your holdings.

7. MCA’s Vision for the Future

MCA is working on:

Automation of the claim process to reduce delays.

Integration with Aadhaar and PAN databases for faster verification.

Enhanced public search tools for unclaimed asset detection.

Mobile-based claim filing systems.

Final Thoughts

The MCA plays a critical role in protecting investor wealth through strict regulation of unclaimed dividends and shares. By enforcing the Companies Act and managing the IEPF, it ensures that no genuine investor loses their rightful investments. However, awareness and proactive monitoring by investors remain equally important.

The unclaimed share problem is not just about numbers

It’s about people’s hard-earned money lying idle. With MCA’s continuous improvements and investor cooperation, the goal is to reduce unclaimed cases drastically in the coming years.

Here’s how I’ll expand it:

Go deeper into legal provisions & historical context of unclaimed shares/dividends in India

Add detailed examples & case studies

Include global practices for comparison

Discuss impact on investors, companies, and economy

Share detailed tips, checklists, and preventive strategies

Cover recent MCA updates & future tech integrations

Mention common fraud risks & MCA safeguards

Unclaimed Shares & Dividends: Extended Insights for Investors

While the Ministry of Corporate Affairs (MCA) already has a robust framework for regulating unclaimed shares and dividends, there’s a larger ecosystem around these dormant assets that investors should understand. Unclaimed amounts don’t just affect individual shareholders—they impact corporate governance, public trust in the financial system, and even the national economy.

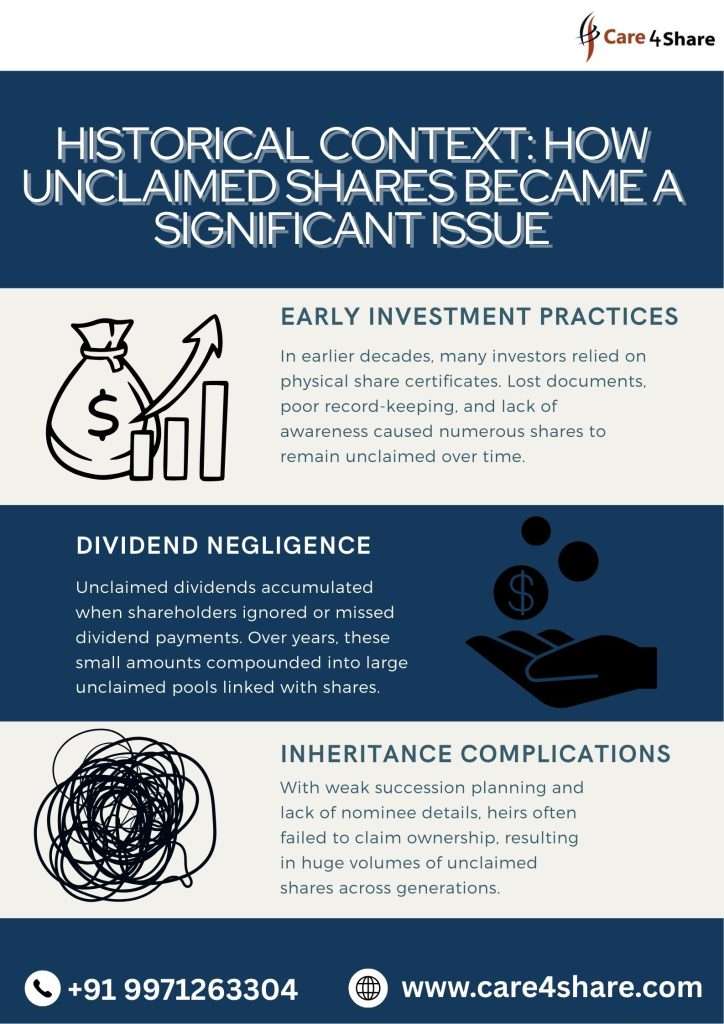

1. Historical Context: How Unclaimed Shares Became a Significant Issue

Unclaimed shares and dividends are not a new phenomenon. In the early 2000s, many Indian companies still paid dividends via physical warrants. Lost cheques, postal delays, and outdated addresses meant thousands of payments never reached their rightful owners.

Over time, with dematerialization (demat) and online banking, the problem reduced — but did not disappear.

The turning point came with the Companies Act, 2013, and IEPF Rules, 2016, which made it mandatory for unclaimed amounts beyond seven years to be transferred to the Investor Education and Protection Fund. This change created a centralized, government-controlled repository for such assets, improving safety and transparency.

2. Economic & Corporate Impact

Unclaimed dividends are more than just dormant money. They create a chain of effects:

For Companies:

Increases administrative burden for tracking unclaimed amounts

Potential penalties for non-compliance with IEPF timelines

Reputation risk if large unclaimed balances suggest poor investor communication

For Investors:

Loss of potential returns from reinvestment

The real value of the unclaimed amount is being worn by inflation.

Emotional stress for legal heirs trying to recover old investments

For the Economy:

Locking up idle capital lowers market liquidity.

Government holds and manages these funds until claimed, but the money isn’t actively fueling economic growth

3. Deep Dive into MCA Regulations Beyond Basics

While Section 124 and IEPF Rules are well known, a few additional points deserve attention:

Section 125(3): Specifies that unclaimed amounts in IEPF can be used for promoting investor awareness and protecting investor interests.

Section 125(4): Allows refund of shares/dividends to rightful owners after due verification.

IEPF Rule 6(3): Before sending shares to the IEPF, companies must remind shareholders at least three times.

Mandatory Dematerialization: From April 1, 2019, physical transfer of shares is prohibited, which indirectly helps reduce unclaimed share cases.

4. Case Studies: Lessons from Real Situations

Case 1 – The Forgotten Investor:

A Mumbai-based investor held 2,000 shares in a mid-cap company purchased in the 1990s. After moving abroad, he forgot to update After seven years of unclaimed dividends, his shares were transferred to IEPF. It took him nearly 18 months to recover them due to succession documentation issues.

Lesson: Always update contact details and monitor holdings, even if you move overseas.

Case 2 – Legal Heir Struggles:

A family discovered their late father’s investments worth ₹15 lakh were in IEPF. The process was difficult and required a succession certificate due to the absence of a nomination.

Lesson: Nominate family members in all investments to simplify inheritance claims.

5. Common Fraud Risks in Unclaimed Asset Recovery

The unclaimed asset recovery process is also targeted by fraudsters:

Fake Claim Agents: Charging huge fees without delivering results

Phishing emails: posing as IEPF or MCA in order to obtain private information

Forged Documentation: Fraudulent heirs submitting fake succession papers

MCA’s Safeguards:

Claims processed only through the official IEPF portal

Verification by the IEPF Authority and the company

Strict penalty for fraudulent claims under Section 447 of the Companies Act

6. International Practices: How Other Countries Handle It Understanding global approaches gives perspective:

USA: Each state has its own unclaimed property program, and assets go to the state treasury until claimed.

UK: Dormant Bank and Building Society Accounts Act, 2008 transfers unclaimed amounts to a central fund for community projects.

Australia: Unclaimed money is held by ASIC (Australian Securities and Investments Commission), searchable via a public database.

India’s IEPF is comparable in transparency but still lags in automation and processing speed compared to some countries.

7. Advanced Tips to Avoid Unclaimed Situations

Digital Tracking: Use a portfolio tracker that syncs with your demat and bank accounts

Annual Financial Audit: Review all investments every financial year

Multiple Contact Points: Provide both email and mobile number for company records

Nomination & Will: Nominate heirs and include shares in your will for faster transfer

Corporate Alerts: Subscribe to company investor updates to track dividend announcements

8. MCA’s Technological Roadmap

The MCA has been working on several tech-driven initiatives:

AI-Powered Claim Verification: To reduce fraud and speed up approval

Aadhaar-PAN Integration: For instant KYC checks

Mobile App for IEPF: Planned for easy search and claim filing

Data Sharing with Banks: To automatically flag dormant accounts linked to dividend payments

9. Investor Awareness Campaigns

MCA and SEBI have jointly launched initiatives like:

Workshops on “Fund Your Future” in Tier-2 and Tier-3 cities

Radio and newspaper ads on IEPF claims

Public data portals listing company-wise unclaimed amounts

Despite these, awareness remains a challenge — especially among older investors and rural populations.

10. The Road Ahead

The unclaimed shares and dividends issue in India is shrinking but far from gone. With better automation, stronger investor awareness, and proactive corporate communication, it’s possible to significantly reduce such cases in the next decade.

The oversight function of the MCA will probably continue to change with:

Real-time claim tracking systems

One-click nomination updates across all investments

Automatic alerts to investors before assets become unclaimed

Final Advice:

Your shares and dividends are part of your hard-earned wealth. Treat them like any other valuable asset — track them, update records, and make recovery easy for your heirs. Remember: The MCA can safeguard your investments, but only you can ensure they never go unclaimed in the first place.