Intro

Long-term wealth can be built by investing in shares. However, what many investors and their families fail to realize is that shares can become unclaimed and end up in the Investor Education and Protection Fund (IEPF). When this happens, the process to recover them becomes long and complicated.

In this article, we’ll explain what causes shares to be transferred to the IEPF, what are the risks involved and most importantly, how you can avoid your shares from becoming unclaimed. Whether you’re an investor, a nominee, or a legal heir, these insights will help you secure your investments for the future.

Understanding IEPF and Unclaimed Shares

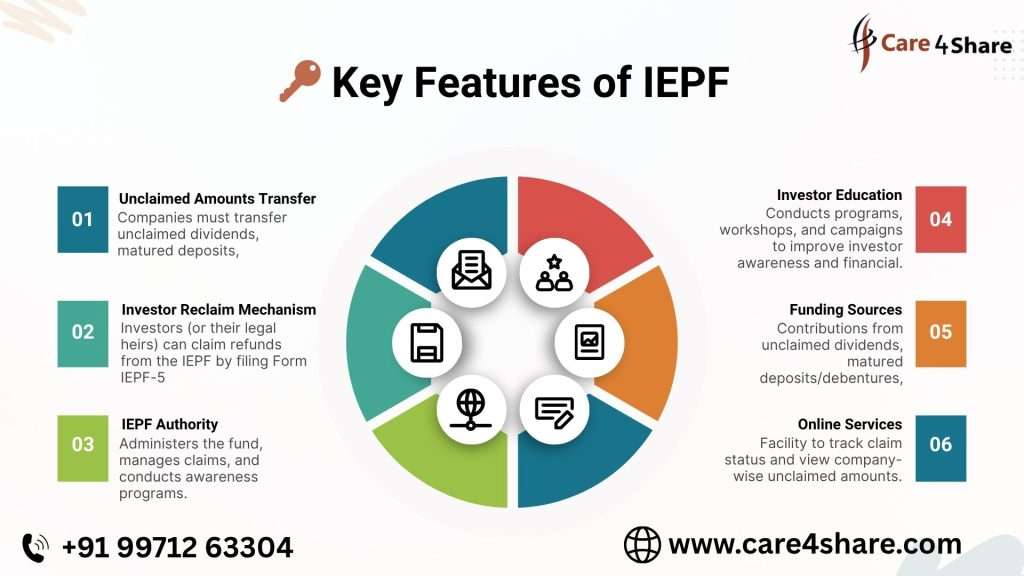

In 2013, the Government created the Investor Education and Protection Fund Authority (IEPFA) to oversee investor-related concerns. It is griped under the Ministry of Corporate Affairs. Its primary purpose is to promote investor awareness and ensure the return of unclaimed or unpaid amounts and shares to rightful claimants.

How Do Shares Become Unclaimed?

Shares become unclaimed when:

In seven consecutive years, shareholders do not claim dividends.

There is no communication or activity from the shareholder’s side.

Contact details or KYC information of the shareholder is outdated or incorrect.

The shareholder has passed away, and the legal heirs are unaware or unable to claim.

If any of the above scenarios occurs, dividends remain unclaimed, and shares corresponding to the unclaimed dividends are transferred to the IEPF.

Key Legal Provision: Rule 6 of IEPF Rules

As per IEPF Authority (Accounting, Audit, Transfer and Refund) Rules, 2016, companies are obligated to transfer shares where dividends have not been claimed for seven consecutive years to the IEPF. This transfer is done along with all the rights attached to those shares, meaning the shareholder temporarily loses control over the asset.

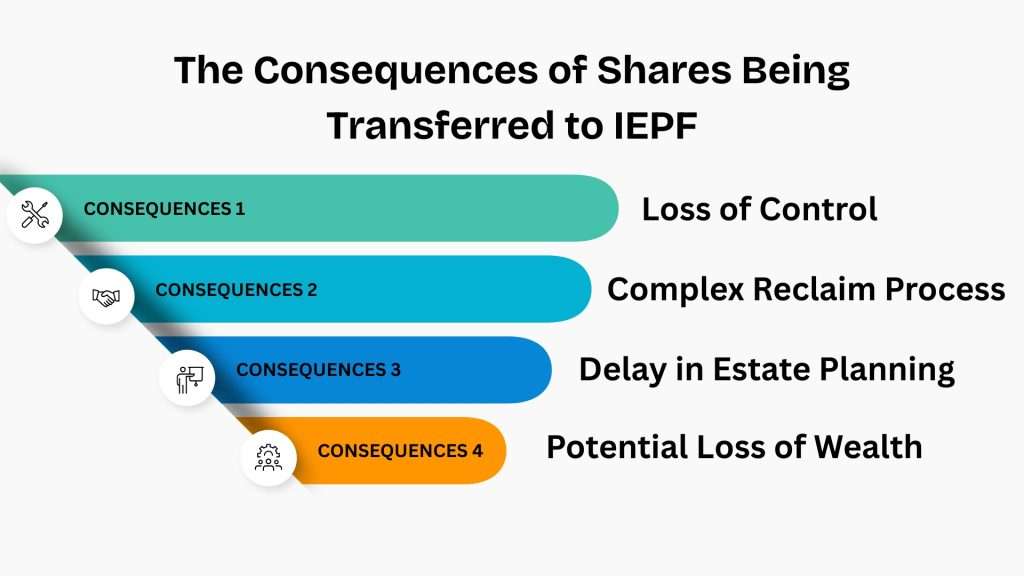

The Consequences of Shares Being Transferred to IEPF

A large number of investors only discover after the fact that their shares have been moved to the IEPF. Here are the consequences:

Loss of Control: You no longer have direct control over your shares until you apply for a refund from IEPF.

Complex Reclaim Process: The process of claiming shares from IEPF involves detailed documentation, notarization, and coordination with both the company and the MCA portal.

Delay in Estate Planning: For legal heirs, it adds a new layer of difficulty during succession or probate proceedings.

Potential Loss of Wealth: Unclaimed shares could grow in value significantly, and without timely intervention, these assets may remain out of reach.

12 Practical Steps to Avoid Your Shares Becoming Unclaimed

Now that you understand the problem, let’s discuss what you can do to prevent your valuable shares from slipping into the IEPF.

- Regularly Claim Your Dividends

- Always keep track of the dividend declaration dates by companies in your portfolio.

- Ensure your bank details (for ECS/NEFT) are correctly updated with your depository participant or the company’s registrar.

- Unclaimed dividends are the root cause—don’t ignore even small amounts.

- Keep Contact Details Updated

- Updating your mobile number, email address, and correspondence address with the company are mandatory. Inactive contact details often lead to companies being unable to reach you.

- Complete and Update KYC Regularly

- Complete your KYC compliance with your depository (NSDL/CDSL) and ensure your PAN, Aadhaar, and contact details are linked.

- Update it whenever there’s a change in personal details like name (after marriage), address, or contact information.

- Dematerialize Your Shares

- Convert physical shares to demat form. Physical shareholding is more prone to being lost, forgotten, or becoming unclaimed.

- Demat shares also provide better transparency and online visibility through your trading platform.

- Monitor Inactive or Dormant Accounts

- If you or your family members have multiple demat accounts, make sure they are reviewed regularly.

- Even if not in active use, dividend activity in these accounts should be tracked.

- Consolidate Shareholding

- Shares are often held in small quantities or scattered across different folios. Consider consolidating these into one folio or demat account.

- This helps you keep track more efficiently and prevents missing dividend credits.

- Nominate a Family Member

- Always assign a nominee to your demat and bank accounts.

- In the event of your demise, the nominee can easily claim or track the investments.

- Many unclaimed shares today are the result of no nominee being declared.

- Educate Your Family

- Keep your family members or chosen heirs updated on:

- The shares you hold

- The platforms where they are held (broker name, DP ID)

- Basic procedures for succession

- Create a shareholding inventory and update it annually.

- Link PAN and Aadhaar

- Government regulations now mandate PAN-Aadhaar linkage for most financial transactions.

- Failure to link can result in your account being flagged or frozen, making it harder to claim dividends.

- Watch for Public Notices

- Companies send public notices before transferring shares to IEPF.

- These are published in national newspapers. If you spot your name, act immediately to claim the dividend or update KYC.

- Reclaim Forgotten Shares Before 7 Years

- You can claim forgotten dividends within 7 years by approaching the company’s Registrar and Share Transfer Agent (RTA).

- Don’t wait for the 7-year mark. Act early to avoid IEPF intervention.

- Keep a Financial Will in Place

- A registered Will can help legal heirs claim the shares and dividends with minimal legal hassle.

- It avoids delays in succession and ensures assets are not permanently lost due to inaction.

If you have any query related to Shares eg. Physical Shares / IEPF refund / claim. We are available

How to Check If Your Shares Are in IEPF?

IEPF shares already owned by you or a family member can be verified here:

Visit: https://www.iepf.gov.in/

Go to “Search for Unclaimed Shares” section.

Enter name, company name, and year.

If any shares are listed, act immediately to initiate the refund process.

Final Thoughts

The unclaimed shares of an investor’s portfolio represent a hidden risk for the investor and his or her family. While the IEPF system is designed to protect shareholders’ interests, reclaiming assets once they’re transferred involves time and effort.

The good news is that this situation is entirely preventable. A proactive approach—claiming dividends, updating records, maintaining communication with registrars, and educating family members—can safeguard your investments for generations.

Don’t let your hard-earned wealth end up in limbo. Take charge now to ensure your shares remain where they belong—with you and your loved ones.

Need Help With Unclaimed Shares or IEPF Refunds?

If you’re already facing issues related to unclaimed shares or need expert guidance on the IEPF recovery process, you can consult companies that specialize in IEPF claim assistance or financial legal advisors.

Professionals can help streamline documentation, liaise with registrars, and follow up with the IEPF authority to ensure a successful refund.