Have you ever wondered what happens to your investments if you forget about them for too long? Many investors in India believe that once they purchase shares, those assets will remain theirs forever, safe in their demat account or recorded with the company registrar. But the reality is quite different. If shares or the dividends attached to them remain inactive for a long time, they do not stay in your possession indefinitely. In fact, there is a legal framework in place that determines the fate of such investments. This brings us to a crucial question: what happens to unclaimed shares after 7 years?

The answer lies in the rules set by the Ministry of Corporate Affairs (MCA). According to the Companies Act, if dividends on any shares remain unclaimed for seven consecutive years, not only do the unpaid dividends get transferred to the Investor Education and Protection Fund (IEPF), but the underlying shares themselves are also moved to the IEPF Authority. This means that your shares—your hard-earned investments—are no longer held in your name after seven years of inactivity. Instead, they are managed by the IEPF until you or your legal heirs take the necessary steps to claim them back.

This process was introduced to protect investors and ensure that idle investments are not misused or lost in corporate records. However, for many individuals, it often results in unintentional financial loss. Imagine losing access to shares in well-known companies just because you didn’t encash a dividend cheque, update your bank details, or complete a transmission after the passing of a family member. Situations like these are far more common than most investors realize, and they are the reason why unclaimed shares after 7 years have become a growing concern across India.

The numbers are staggering. Official data reveals that shares worth thousands of crores have already been transferred to the IEPF over the past decade. A large portion of these belong to everyday investors—professionals, senior citizens, and legal heirs—who simply lost track of their investments or were unaware of the regulatory timelines. These are not small amounts; they represent wealth that could have helped families pay for education, medical treatment, or retirement. Instead, these shares sit in the custody of the IEPF, waiting to be reclaimed through a lengthy process.

The critical point here is awareness. Most investors don’t even know that such a rule exists. They continue to believe that their investments are secure, while the clock quietly ticks toward the seven-year mark. When they finally realize what has happened, reclaiming these shares involves navigating through procedural hurdles, documentation requirements, and legal formalities. While recovery is possible, the process can be time-consuming and overwhelming for those unfamiliar with the system.

In this blog, we will break down everything you need to know about unclaimed shares after 7 years—why shares are transferred to the IEPF, the legal provisions behind it, and the exact steps you can take to recover them. Understanding this timeline is not just important; it’s essential if you want to protect your wealth and ensure that your family does not lose out on investments that rightfully belong to you.

Understanding Unclaimed Shares

Unclaimed shares are the assets held by investors who lose track of their ownership because of various reasons prevailing in the market. This may occur due to:

- Failure to update contact information with the company or registrar.

- Lack of awareness about dividend declarations or bonus issues.

- Unforeseen circumstances like the death of the shareholder without proper transmission.

- Ignorance regarding physical share certificates not being dematerialized.

Legal Framework Governing Unclaimed Shares

The handling of unclaimed shares varies across the world, but the intent remains universal. To safeguard the interests of investors and ensure unused assets do not remain idle indefinitely is the only motive of the various jurisdictions across the globe. In this article we will examine how India’s jurisdictions address the issue.

The Investor Education and Protection Fund (IEPF)

In India, the Companies Act, 2013, and the Investor Education and Protection Fund Authority (Accounting, Audit, Transfer, and Refund) Rules, 2016, provide the legal framework for unclaimed shares. According to these provisions:

Retention Period

Transfer to IEPF

Claiming Shares from IEPF

1. Retention Period

Companies are required to hold unclaimed shares for seven years.

2. Transfer to IEPF

After seven years, unclaimed shares, along with unclaimed dividends, are transferred to the Investor Education and Protection Fund (IEPF).

3. Claiming Shares from IEPF

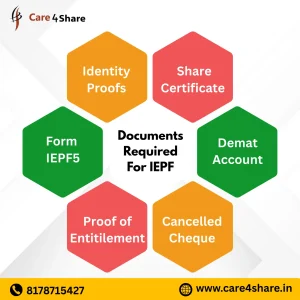

Investors or legal heirs can reclaim their shares and dividends by filing the necessary forms, such as IEPF-5, and submitting relevant documents.

The IEPF acts as a repository, ensuring that unclaimed shares are not misused while providing mechanisms for rightful owners to reclaim them.

Process of Transferring Unclaimed Shares

The transfer of unclaimed shares after 7 years typically involves the following steps:

- Identification: Companies identify shares and dividends that have remained unclaimed for seven years.

- Notification: Attempts are made to contact the shareholder through registered addresses, emails, or phone calls.

- Publication: Some jurisdictions require public notices in newspapers or company websites as a final attempt to reach shareholders.

- Transfer: If no response is received, the shares are transferred to the designated authority, such as the IEPF in India or the state treasury in the US.

Implications for Shareholders

The transfer of unclaimed shares after has significant implications for investors:

- Loss of Ownership: While the ownership does not technically cease, the process of reclaiming shares can be time-consuming and complex.

- Loss of Dividends: Unclaimed dividends are also transferred along with shares, meaning shareholders miss out on potential income.

- Administrative Challenges: Reclaiming shares requires meticulous documentation, including proof of ownership, identity verification, and, in cases of inheritance, legal heir certificates or wills.

Preventing Shares From Becoming Unclaimed After 7 Years

Investors can take several steps to ensure their shares do not fall into the category of unclaimed assets years:

- Update Contact Information: Notify the company or registrar of any changes in address, phone number, or email.

- Dematerialization: Convert physical share certificates to electronic form, as it reduces the risk of loss or theft.

- Nomination: Appoint a nominee for all investments to facilitate seamless transfer in the event of unforeseen circumstances.

- Periodic Monitoring: Regularly review investment portfolios and bank accounts for credits of dividends or interest.

Reclaiming Unclaimed Shares

Reclaiming unclaimed shares after 7 years, their transfer requires adhering to jurisdiction-specific processes. For instance:

- Visit the IEPF’s official portal.

- File Form IEPF-5 with details of the unclaimed shares and dividends.

- Submit supporting documents, including identity proof, address proof, and shareholding proof.

- Coordinate with the company’s nodal officer for verification.

- Upon successful verification, the shares and dividends are credited back to the rightful owner.

Social and Economic Impact of Unclaimed Shares

Unclaimed shares are often a significant source of idle money. Governments and authorities use these assets for public welfare or developmental projects, ensuring that they contribute to the economy rather than lying dormant. However, the focus remains on balancing social benefit with the protection of individual property rights.

Conclusion

The fate of unclaimed shares after 7 years is determined by a blend of legal mandates, administrative processes, and investor vigilance. While regulations like the IEPF in India safeguards unclaimed assets. By understanding the laws governing unclaimed shares and taking proactive steps, investors can ensure their assets remain secure. Furthermore, those who discover unclaimed shares after years can still reclaim them through appropriate channels, emphasizing the importance of financial awareness and diligence.

FAQ

What happens to shares that are not claimed?

In cases where shares have been neglected for a period of 7 years due to not being claimed, they are given the right to be moved to the IEPF. These shares are in fact the property of the owner, so they are eligible to be reclaimed through the IEPF Authority via a request and necessary paperwork.

What could happen if the dividend is not claimed for 7 years?

If dividends remain unclaimed for seven consecutive years, they, along with the corresponding shares of the shareholder, become liable to be transferred to the Investor Education and Protection Fund (IEPF).

What are the processes in losing shares and recovering unclaimed shares?

Recovering shares is as simple as filling out a form, in this case the form is called IEPF-5. After filling out this form IEPF, you must submit the necessary paperwork to the company’s Nodal Officer, where the verification for the final approval is conducted.

How are shares verified to see if they have been moved?

In order to see if the shares are unactive, are active or have been moved, you can check through the demat account, give the company a call for the RTA, or check the IEPF’s search portal.

How much are unclaimed shares in India?

The most recent statistics, more than 1 trillion worth of shares have not been claimed and over 1,000,000 of the people have not claimed their shares and dividends.