INTRODUCTION

The Investor Education and Protection Fund (IEPF) was created under the Companies Act to safeguard unclaimed investments such as shares and dividends that remain unpaid or unclaimed for long periods. For many investors in India, a common question arises: How long does it take to recover shares and dividends once they are transferred to IEPF? This blog will explain the IEPF timeline for refund of shares and dividends, the step-by-step process, and practical tips to ensure smooth recovery.

Why Shares and Dividends Go to IEPF

According to Section 124(5) of the Companies Act, 2013, if any dividend has not been claimed for seven consecutive years, the unpaid dividend along with the related shares is transferred to the IEPF. This mechanism ensures that unclaimed investments are protected until rightful owners or their legal heirs claim them.

But once these investments are transferred to the IEPF, recovering them requires following a systematic process. The timeline of this refund depends on several steps, including document submission, verification by the company, and approval by the IEPF Authority.

Typical Timeline for Refund of Shares and Dividends

The IEPF claim process generally takes 3 to 6 months under normal circumstances. However, the exact timeline depends on:

- Accuracy of documents submitted

- The efficiency of the company’s nodal officer and registrar

- The workload at the IEPF Authority

Filing IEPF-5 Form Online (Day 1)

The process begins when the claimant files the IEPF-5 form online through the Ministry of Corporate Affairs (MCA) portal. The form requires details such as the company name, CIN, folio/demat number, Aadhaar, and bank account details.

Submission of Documents to Nodal Officer (Within 15 Days)

After filing the IEPF-5 form, the claimant must send the physical documents (duly signed form, indemnity bond, share certificates if physical, and supporting KYC documents) to the company’s nodal officer within 15 days.

Verification by Company (15 to 30 Days)

The nodal officer verifies the claim, checks the supporting documents, and issues a verification report to the IEPF Authority. This step usually takes around 2 to 4 weeks.

Scrutiny by IEPF Authority (60 Days)

Once the verification report is received, the IEPF Authority reviews the application. By law, the authority is expected to process claims within 60 days of receiving the company’s report.

Refund of Shares and Dividends (3 to 6 Months Total)

After approval, the dividend is directly credited to the claimant’s bank account, while the shares are transferred to the claimant’s demat account. In practice, the entire process may take around 90 to 180 days.

Factors That Can Delay the Refund Process

While the statutory timeline is around 60 days after company verification, many investors experience delays. Here are common reasons:

Incomplete Documentation

Missing share certificates, incorrect bank details, or incomplete succession documents often delay approval.

Legal Heir Cases

If the original shareholder has passed away, additional documents like succession certificates or legal heirship affidavits are required, which take time to procure.

Company Delays

Some companies take longer than expected to issue verification reports.

Technical Issues

Errors in form IEPF-5 filing, mismatched PAN/Aadhaar details, or inactive demat accounts can slow the process.

High Volume of Claims

The IEPF Authority sometimes takes longer due to the large number of pending applications.

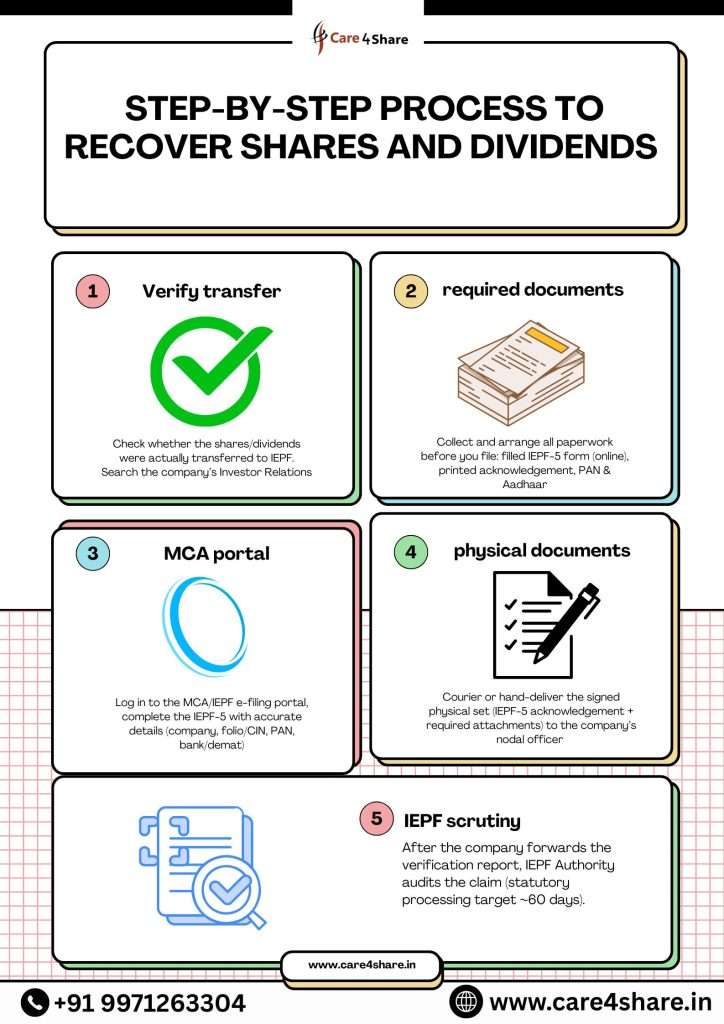

Step-by-Step Process to Recover Shares and Dividends

To better understand the timeline, here is the complete process:

Check Eligibility

Confirm whether your shares or dividends have been transferred to the IEPF by checking the company’s website or MCA portal.

Prepare Document

- Duly filled IEPF-5 form (online)

- Acknowledgement copy

- Indemnity bond (on non-judicial stamp paper)

- Advance receipt (signed by claimant and bank manager)

- Original share certificates (if physical shares)

- PAN, Aadhaar, and other KYC documents

- Demat account details

- Legal heir documents (if applicable)

File IEPF-5 Form Online

Submit the form through the MCA website and take a printout of the acknowledgement.Send Documents to Company Nodal Officer

Courier or submit the documents within 15 days of filing the form.Company Verification

The company’s nodal officer checks the documents and forwards a verification report to IEPF Authority within 15–30 days.IEPF Authority Processing

The authority reviews the documents and issues approval within 60 days of receiving the report.Refund Credit

- Dividends → credited to the registered bank account.

- Shares → transferred to the demat account.

IEPF Timeline at a Glance

Step | Responsible Party | Timeline (Approx.) |

|---|---|---|

Filing IEPF-5 form | Investor | Day 1 |

Submission of docs | Investor | Within 15 days |

Company verification | Nodal Officer | 15–30 days |

IEPF scrutiny | IEPF Authority | 60 days |

Final refund | IEPF Authority | 3–6 months total |

Tips to Speed Up the Refund of Shares and Dividends

- Ensure Correct Documentation: Double-check all documents before submission.

- Update Demat and Bank Details: Make sure accounts are active and KYC compliant.

- Track Claim Status: Regularly follow up with the company’s nodal officer.

- Respond Promptly: If the IEPF Authority asks for clarification, reply immediately.

- Seek Professional Help: For complex cases, such as legal heir claims, consult an expert to avoid delays.

Common Questions on IEPF Timeline

Q1. How long does it take to get dividends refunded from IEPF?

Usually 3 to 6 months, depending on document accuracy and verification speed.

Q2. Can the timeline be shorter?

Yes, if documents are complete and company/IEPF authority processes are efficient, it may take around 2 to 3 months.

Q3. Why do some cases take more than 6 months?

Mostly due to legal heirship issues, incomplete documents, or company delays in sending verification reports.

Q4. How will I receive my refund?

Dividends are credited to your bank account, while shares are transferred to your demat account.

Future of IEPF Claims and Timelines

The Ministry of Corporate Affairs is working on digitizing and simplifying the IEPF refund process. With more online integration between RTAs, depositories, and the IEPF Authority, the timelines are expected to reduce in the future. This will make recovery of shares and dividends faster and hassle-free.

Conclusion

Recovering investments from IEPF is not instantaneous, but with the right documentation and timely follow-up, investors can reclaim their shares and dividends within a reasonable period. On average, the IEPF timeline for refunds is 3 to 6 months, though it can be shorter or longer depending on the case. By understanding the process, preparing documents in advance, and avoiding common mistakes, you can ensure that your rightful investments are returned to you smoothly.