How to Reclaim Unclaimed Dividends from Multiple Companies: A Step-by-Step Guide

Have you or anyone in your family ever lost track of past stock investments or neglected to collect dividends from companies you used to own? If so, you’re not the only one. Every year, hundreds of Indian investors face the same issue: they leave behind unclaimed dividends, matured deposits, or shares. Over time, if these remain unclaimed, the corporations must transfer them to the Investor Education and Protection Fund (IEPF) as required by law. This is where the idea of unclaimed shares recovery becomes very essential.

Unclaimed shares recovery is a way for investors and their legal heirs to reclaim shares and dividends that may have been lost, forgotten, or stuck due to reasons like moving to a new address, losing share certificates, having mismatched names, not updating KYC details, or even the unfortunate death of the original shareholder. Many families only discover these unclaimed assets years later when they begin organizing their finances, settling estates, or tracing investments made by their ancestors.

While the chance to reclaim wealth exists, the unclaimed shares recovery process can be lengthy and complicated. From gathering the right set of documents, filing claims with the IEPF Authority, coordinating with the company’s nodal officer, to addressing succession matters with legal heirs—the tasks can feel overwhelming for someone unfamiliar with the procedure.

This is why seeking professional help is highly recommended. A trusted IEPF consultant can simplify the entire unclaimed shares recovery process for you. They provide end-to-end support with paperwork, ensure compliance with regulations, and accelerate claim settlement. Whether your unclaimed dividends come from a single company or are scattered across multiple organizations, expert consultants ensure that your rightful assets are recovered smoothly and without unnecessary stress.

In the following sections, we’ll explain how unclaimed shares recovery works, the common challenges investors face, and why professional guidance is the most effective approach to reclaim your wealth.

Know more about IEPF.

What Are Unclaimed Dividends?

When dividends declared by companies remain unclaimed by shareholders for seven consecutive years, both the dividend amount and the related shares are transferred to the IEPF. These can still be recovered, but only after a formal claim process.

Why Are Dividends Unclaimed Across Multiple Companies?

Some common reasons include:

- Change of address or phone number

- Lost or forgotten investments

- Death of the original shareholder

- Shares held in physical form and not dematerialized

- Nominee/legal heir not aware of investments

When this happens across different companies, the process of IEPF share recovery becomes more complex—but not impossible.

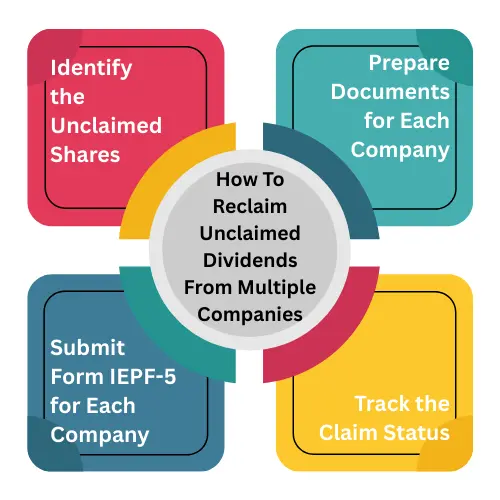

How to Reclaim Unclaimed Dividends from Multiple Companies

Here’s a simplified step-by-step process to help you recover what’s rightfully yours:

1. Identify the Unclaimed Shares

First, gather all old documents, including:

- Share certificates (if physical)

- Demat account statements

- Past dividend records

- PAN & Aadhaar of the shareholder

You can also check the company’s website or the IEPF Authority website to identify unclaimed shares and dividends.

2. Prepare Documents for Each Company

Each company requires specific documents like:

- Claimant’s ID and address proof

- Client Master Report (CMR) from the demat account

- Original share certificates (if available)

- Legal documents in case of deceased shareholder: death certificate, succession certificate, or legal heir certificate

If you are dealing with 3–4 companies, managing these separately can get overwhelming—this is where professional help is useful.

3. Submit Form IEPF-5 for Each Company

You need to file IEPF Form-5 online on the MCA portal for each company. A separate form is required per company.

After filing:

Take a printout and attach self-attested documents

Send the form and attachments to the Nodal Officer of the company

Follow up actively for confirmation

4. Track the Claim Status

After submission, you’ll receive a Service Request Number (SRN). Use it to monitor your claim status online or via email to the company.

Why Choose an IEPF Consultancy?

When dealing with unclaimed dividends from multiple companies, it’s advisable to seek help from a professional firm. A certified IEPF consultancy near you can:

- Reduce documentation errors

- Handle legal formalities on your behalf

- Speed up the approval process

- Save time and follow up with nodal officers

Companies like Care4Share specialize in share recovery from IEPF and can manage end-to-end processes, especially if you’re unsure about legal or technical paperwork.

Conclusion

Unclaimed dividends and shares might seem lost—but they’re not. With proper documentation, follow-up, and help from professionals, unclaimed shares recovery is very much possible, even from multiple companies.

If you believe your family has old investments that haven’t been claimed, don’t wait. Begin the process today and reclaim your rightful assets from IEPF.