One of life’s most potent instruments is money; it may provide opportunity, ease tension, and grant freedom. However, a lot of people have trouble managing their finances because they never developed sound financial habits at the appropriate period.

The key to financial discipline is managing your money well, not how much you make. The truth is, smart money habits matter more than income levels. Someone earning ₹40,000 with discipline can build more wealth than someone earning ₹1,00,000 without financial control.

Habits hold the key. Small, repetitive behaviors that build up over time are called habits. Money habits create financial strength in the same way that fitness habits create a strong physique.

Every decade of life presents different financial difficulties: You’re just getting started in your 20s. A lack of financial literacy, high expectations, and a limited salary can make or ruin your future.

As your salary increases in your 30s, you also have more obligations, such as a family, kids, house mortgage, and living expenses.

The emphasis moves from building wealth to protecting it as you start to realize that retirement is not too far off in your 40s.

In order to achieve financial independence, prevent regrets, and lead a stress-free life, we’ll examine the wise financial practices you should develop in your 20s, 30s, and 40s in this comprehensive book.

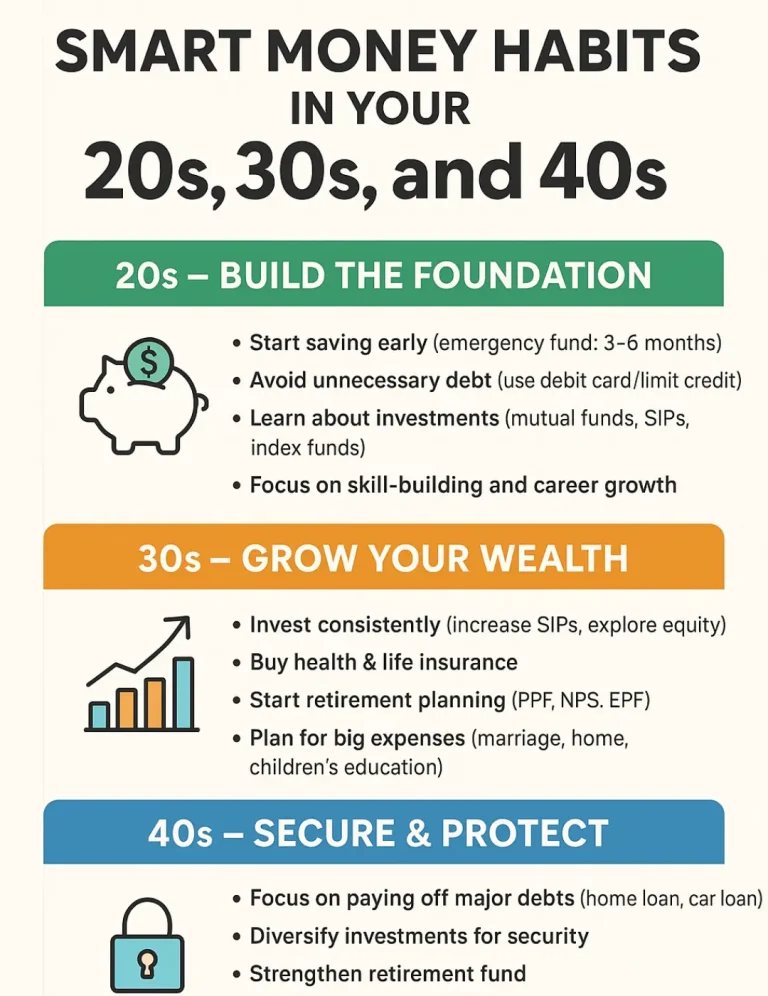

Smart Money Habits in Your 20s – Building the Foundation

Financial Practices in Your 20s: Establishing the Groundwork

Focus: Acquiring knowledge, conserving, and avoiding errors

Focus: Acquiring knowledge, conserving, and avoiding errors

Your twenties are the perfect time to begin practicing smart money habits like budgeting, avoiding unnecessary debt, and learning how to invest early. Many people are experiencing their first job, first paycheck, and first taste of financial freedom throughout this decade. While it may be tempting to spend money on vacations, electronics, or dining out, these are also the years to lay the groundwork for long-term financial success.

1. Begin creating a budget

The goal of early budgeting is knowledge, not limitations. You take charge when you keep tabs on your earnings and outlays. Money swiftly vanishes without a budget, leaving you to wonder where it went.

50% For Necessities

(bills, groceries, and rent)

30% For

Wants

(entertainment, technology, and travel)

For instance, a salary of ₹30,000 would go toward ₹15,000 for necessities, ₹9,000 for wants, and ₹6,000 for savings. At 12% yields, a monthly investment of ₹6,000 can increase to ₹1 crore over a 25-year period.

2. Emergency Fund: Your Protective Structure

Building an emergency fund is one of the smartest money habits in your 20s because it shields you from financial shocks. This should cover expenses for at least three to six months. Store it in a liquid fund or high-interest savings account.

Why it's important

- Loss of employment? covered.

- Unexpected medical costs? covered.

- A sudden family emergency? Covered.

3. Managing Debt: Steer Clear of the Trap

Though helpful, credit cards can be harmful if used improperly. Interest rates range from 30 to 40 percent per year when minimum dues are paid. As a general rule, you should never spend more than you can afford to pay back each month.

Loans for luxury goods, trips, or electronics should be avoided, but student loans are fine if they improve your earning potential.

4. Investing

Start Small, Think Big Time is your greatest asset when you’re in your 20s. Over decades, even modest investments rise significantly.

- SIPs for mutual funds offer low risk and long-term potential.

- Index funds: cheap cost, risk diversification

- PPF → Long-term, safe, and tax-saving wealth

- List ItemStocks: Higher risk, higher reward (assuming you know what you're doing).

For instance, investing ₹5,000 a month from the age of 25 to the age of 55 equals ₹1.75 crore. The price drops to ₹60 lakh if you wait till age 35.

5. Insurance: Guard Yourself Before You Develop

By paying your medical bills, health insurance keeps you from running out of money.

You should purchase term life insurance if you are the primary provider for your family.

6. Financial Education: Power Comes from Knowledge

Your twenties are the ideal years to learn. Read books like The Psychology of Money by Morgan Housel.

- Rich Dad, Poor Dad (Kiyosaki, Robert)

- Your Money or Your Life (Vicki Robin)

Additionally, subscribe to podcasts, YouTube channels, and blogs about finance.

Checklist for Your 20s

Make a budget

Build emergency savings

Avoid high-interest debt

Start investing small

Buy insurance

Learn money management

Smart Money Habits in Your 30s – Growth & Stability

In your 30s, smart money habits shift from just saving to balancing family responsibilities, investments, and future planning. Salaries are higher, but so are expenses—marriage, children, home loans, and lifestyle upgrades.

1. Increase Your Savings Rate

With a higher income, aim to save 30–40% instead of 20%. Automate investments so savings happen before spending.

2. Upgrade Insurance Coverage

Now that you may have dependents, review your insurance:

- Life insurance = at least 10–15x annual income

- Health insurance = sufficient family cover + critical illness riders

3. Retirement Planning: No More Delays

One of the most critical smart money habits in your 30s is not delaying retirement contributions.

- Contribute regularly to EPF and PPF Invest in NPS (National Pension System) for tax benefits

- Allocate a part to equity mutual funds for long-term growth

4. Savings Based on Goals

Typical objectives for the 30s include:

- Purchasing a home

- Education of children

- Creating wealth for the future ,

- Ideal getaways

- To prevent misunderstandings

- allocate distinct funding for every objective.

5. Techniques for Paying Off Debt

Pay off high-interest obligations as soon as possible. Select repayment plans carefully for larger debts (such as housing loans):The Avalanche Method:

- The Snowball Method → First, pay off the smallest loan.

- Pay off the loan with the highest interest rate first

6. Make Your Portfolio More Diverse

Distribute your investments among: Equity (stocks, mutual funds)

Debt (bonds, debt funds, and FDs)

Gold (digital gold, ETFs)

Real estate (if feasible and reasonably priced)

Avoid these mistakes when you’re in your 30s: excessive spending brought on by rising living expenses

Ignoring retirement in favor of short-term objectives

Refusing to upgrade insurance

Checklist for Your 30s

Save 30–40% of income

Upgrade insurance policies

Start serious retirement planning

Save for big goals

Clear high-interest debt

Diversify investments

40s Smart Money Habits

By your 40s, the focus of smart money habits moves from wealth creation to wealth protection and retirement readiness.

The “make or break” decade is your forties. Making decisions today will determine whether you have a comfortable or difficult retirement in 15 to 20 years.

1. Annually Rebalance the Portfolio

Gradually reduce your exposure to equity. Opt for safer alternatives such as debt funds, bonds, or balanced funds.

2. Give Retirement Corpus Priority

Goal: Create a retirement account that will cover expenses for at least 25 years after retirement. Take inflation into account.

3. Reduce Obligations

Aim for debt-free status by your late 40s or early 50s.. Peace of mind is guaranteed by a debt-free retirement.

4. Make Emergency Savings Stronger

The costs have increased by now. Increase your emergency savings until it can cover expenses for at least a year.

5. Sources of Passive Income

Create a source of income outside of work:

Income from rentals

Stocks that pay dividends

Side ventures or consultancy jobs

6. Planning an Estate

Smart money habits at this stage include drafting a will, updating nominees, and securing wealth transfer. Arrange the transfer of money to prevent conflicts:

- Update the nominations for banks and insurance.

- If applicable, take trust funds into account.

- Avoid These Errors in Your Forties

- Putting children's aspirations ahead of retirement

- Ignoring medical examinations

- Continuing to make hazardous investments

Checklist for Your 40s

Rebalance portfolio

Maximize retirement savings

Minimize or clear debts

Build passive income streams

Plan estate and succession

Investment Platforms: ET Money, Groww, and Zerodha

Reading List:

- Benjamin Graham, The Astute Investor

- Thomas J. Stanley, Millionaire Next Door

- "I'll teach you how to be wealthy," said Ramit Sethi.

How IEPF Aids in Astute Financial Management

The Indian government created the Investor Education and Protection Fund (IEPF) to protect investors and their unclaimed money. Shares, dividends, term deposits, mutual funds, and matured policies are examples of old assets that many people forget about and that frequently lay dormant. The IEPF guarantees that it is protected and available for claim by the legitimate owners or their successors, rather than being wasted.Checking the Investor Education and Protection Fund (IEPF) is also part of smart money habits, since unclaimed investments can quietly erode family wealth if ignored.

1. Recovering Investments That Were Unclaimed

People may eventually switch banks, jobs, or addresses and forget about:

- previous ownership stakes in businesses

- Dividends that are not claimed

- Debentures or matured deposits

- Amounts in mutual funds

- Payouts from insurance

The IEPF receives these unclaimed monies. You can reclaim investments that you or your family members have forgotten through the correct procedure. 👉 This is in line with prudent financial practices throughout your 30s and 40s, which include going over all of your assets and making sure nothing is sitting about.

2. Protecting Family Wealth

In many cases, family members are unaware of investments made by parents or grandparents. After seven years of inactivity, these funds move to the IEPF. By keeping track of family assets and filing claims, you ensure no wealth is lost.

👉 This links directly to estate planning and wealth transfer habits recommended in your 40s.

Recovering Investments That Were Unclaimed

Protecting Family Wealth

Promoting Financial Literacy

Encouraging Accountability

3. Promoting Financial Literacy

The IEPF also runs awareness programs to educate people about investing safely, avoiding fraud, and planning for the future. It helps individuals understand their rights as investors.

👉 This complements the financial education habit you should adopt in your 20s.

4. Encouraging Accountability

By reclaiming forgotten investments, you not only protect wealth but also develop the habit of regular financial tracking. This prevents assets from being lost due to negligence.

Case study

Learning the Fundamentals in His 20s

At the age of 22, Rohan, a recent Delhi graduate, began his first job. Like other kids, he wanted to have fun and spend as much money as he wanted. However, he made the decision to monitor his spending and set aside at least 20% of his income after participating in a financial literacy course.Rohan began adopting smart money habits early—budgeting, investing through SIPs, and avoiding credit card debt.

He made minor SIP investments in mutual funds and started a recurring deposit.

He preferred to make purchases with his debit card and avoided credit card debt.

He bought basic health insurance and a term life insurance policy with his first bonus.

He had four months’ worth of expenditures saved up by the time he was 25, which provided him stability and confidence.

In His Thirties: Development and Obligations

By his 30s, these smart money habits helped Rohan balance higher expenses while still securing his family’s future. His career had expanded by his early thirties. He had a child after getting married. This meant greater financial objectives and increased obligations.

He began investing in PPF, diversified into debt and equities funds, and raised his SIPs.

He purchased life insurance with more coverage and upgraded his health insurance to include his family.

Through a special education fund, Rohan and his spouse started saving for their child’s schooling.

To lessen the strain of his debt, he paid off his auto loan early.

These practices allowed him to reconcile long-term planning with family requirements and prevented him from feeling overburdened by bills.

In His Forties: Getting Ready for the Future

In his 40s, smart money habits like rebalancing his portfolio and estate planning kept him on track for a stress-free retirement.

Every year, he rebalances his portfolio according to risks after reviewing it.

To ensure retirement income, he makes the most of his NPS and PPF contributions.

His responsibilities have decreased; he only has a tiny home loan left, which he intends to pay off before turning 50.

To ensure his family’s future, Rohan has begun estate planning by drafting a will and changing the nominees in all accounts.

Rohan is on course to retire stress-free, financially independent, and with peace of mind because he started early and remained persistent.

In your 40s, protect your money, pay off your debts, and get ready for retirement.

FAQ’s

Here are some common questions people ask about developing smart money habits across decades:

What are the best money habits in your 20s?

Budgeting, avoiding debt, building an emergency fund, starting investments, and getting basic insurance.

How much should I save in my 30s?

Aim for 30–40% of your income, split between retirement, short-term goals, and emergency funds.

Is 40 too late to start saving for retirement?

No, but you must be aggressive. Increase contributions, reduce debt, and focus on secure investments.

Should I prioritize children’s education or retirement in my 40s?

Retirement first. Education can be financed through loans or scholarships, but you can’t borrow for retirement.

What’s the most common money mistake across all ages?

Delaying saving and investing. The earlier you start, the less pressure you’ll feel later.