Intro

Have you or someone in your family ever forgotten about old share certificates or missed dividend payments? You’re not alone. Every year, crores of rupees worth of unclaimed shares and dividends remain stuck in the Investor Education and Protection Fund (IEPF) because investors either lost their certificates, changed addresses, or simply forgot about their investments.

Among these cases, a significant portion involves Nidhi company shares — small financial cooperatives that operate under the principle of mutual benefit. If your shares from a Nidhi company have been transferred to IEPF, the good news is you can recover unclaimed shares by following a defined process set by the Ministry of Corporate Affairs (MCA).

This comprehensive guide will explain the IEPF refund process, the role of a Nidhi company, and how Care4Share IEPF experts can make recovery simple and stress-free.

What Is IEPF? (Investor Education and Protection Fund)

The Investor Education and Protection Fund (IEPF) was established under the Companies Act, 2013 to safeguard the interests of investors. When shareholders do not claim dividends or fail to trade their shares for seven consecutive years, those shares and the related dividend amounts are transferred to the IEPF by the company.

The IEPF ensures that unclaimed money and shares are protected from misuse and can be reclaimed by rightful investors through an official IEPF refund process.

Key functions of IEPF include:

Protecting investor funds and promoting awareness.

Handling unclaimed dividends, matured deposits, and unclaimed shares.

Providing a secure platform for shareholders to file refund claims via IEPF Form 5 process.

What Is a Nidhi Company?

A Nidhi company is a type of Non-Banking Financial Company (NBFC) established mainly to encourage its members to save and lend money among themselves.

Governed by: MCA under the Nidhi Rules, 2014

Nature: Mutual benefit society (members-only transactions)

Services: Accepts deposits and provides secured loans

Regulation: Exempted from core RBI regulations, but under the Companies Act, 2013 for compliance and IEPF transfers

Even though Nidhi companies function differently from public companies, they must follow the same legal process for unclaimed shares and dividend transfers to the IEPF.

These companies are regulated by the Ministry of Corporate Affairs (MCA) under Nidhi Rules, 2014, and are exempted from the core RBI regulations. Though Nidhi Companies operate differently from regular public companies, they are still governed under the Companies Act for matters such as shareholding and IEPF.

Why Do Nidhi Company Shares Become Unclaimed?

There are many reasons why Nidhi company shares end up being unclaimed or transferred to the IEPF.

Common Reasons:

Outdated communication details – Investors fail to update new address, phone number, or email.

Lost or misplaced share certificates – Many investors still hold physical shares instead of converting them into Demat form.

Demise of original shareholder – Legal heirs may not be aware of the investment.

Migration or relocation – Change of city or country without updating company records.

Negligence – Ignoring small dividend payments that accumulate over time.

If a shareholder does not claim dividends or make any transaction for seven consecutive years, the company is legally required to transfer those shares to the IEPF.

Can You Recover Unclaimed Shares from IEPF?

Yes, absolutely!

The IEPF refund process allows every investor or their legal heir to reclaim their unclaimed shares, dividends, or interest amounts transferred to the IEPF.

According to Rule 7 of the IEPF Authority (Accounting, Audit, Transfer and Refund) Rules, 2016, the rightful claimant can apply using IEPF Form 5 and follow the official procedure for recovery.

Complete Step-by-Step Process to Recover Unclaimed Shares from IEPF

Let’s go through the exact steps you must follow to recover unclaimed shares of a Nidhi company.

Step 1: Verify Transfer to IEPF

Before filing any form, confirm that your shares or dividends have indeed been transferred to the IEPF.

Visit the official IEPF website (https://www.iepf.gov.in/IEPF/)

Click on “Search Unclaimed Shares / Dividends”

Enter shareholder details like your name, folio number, or company name

The portal will show whether your shares or dividends are held by the IEPF

This verification ensures your claim is valid before proceeding further.

Step 2: Gather Required Documents

Prepare the following documents to avoid delays:

For Individual Shareholders:

Self-attested PAN and Aadhaar

Cancelled cheque (name pre-printed)

Client Master List (CML) from your Demat account

Original share certificate (if available)

Proof of ownership (dividend warrant, allotment letter, etc.)

Advance stamped receipt and indemnity bond as per IEPF format

For Legal Heirs or Nominees:

Death certificate of the shareholder

Succession certificate / Probate of Will / Legal Heir Certificate

PAN & Aadhaar of all heirs

No Objection Certificate (NOC) from other legal heirs

Transmission documents (if not done earlier)

Incomplete or mismatched documents are the biggest reasons for rejection, so double-check everything carefully.

Step 3: File IEPF Form 5 Online

Now visit the official IEPF portal and fill the Form IEPF-5:

Go to the “Forms” section → Select “Form IEPF-5”

Fill in:

Investor’s PAN, Aadhaar, mobile number

Company CIN and name (Nidhi Company)

Details of shares (Folio No., type, quantity)

Dividend details (if applicable)

Upload scanned copies of the required documents

Submit and note down the SRN (Service Request Number) for tracking

Step 4: Send Physical Documents to the Company

After online submission, send a hard copy of the IEPF Form 5 along with self-attested documents to the Nodal Officer of the Nidhi company by Speed Post or Courier.

Include:

Duly signed acknowledgment of Form IEPF-5

Self-attested PAN, Aadhaar, and CML

Original share certificates (if available)

Indemnity bond and advance stamped receipt

Step 5: Company Verification

The Nidhi company’s Nodal Officer will verify:

Whether you are the rightful shareholder or legal heir

Whether the claim matches the internal share register

Whether all documents are complete

Once verified, the company sends a recommendation letter and verified documents to the IEPF Authority for final approval.

Step 6: IEPF Authority Approval & Refund

After receiving the verified claim from the company, the IEPF Authority reviews all details and processes the refund.

If approved:

The recovered shares are credited directly to your Demat account.

The unclaimed dividends refund is transferred to your registered bank account.

⏳ Timeline: Typically 3–6 months depending on documentation and company response time.

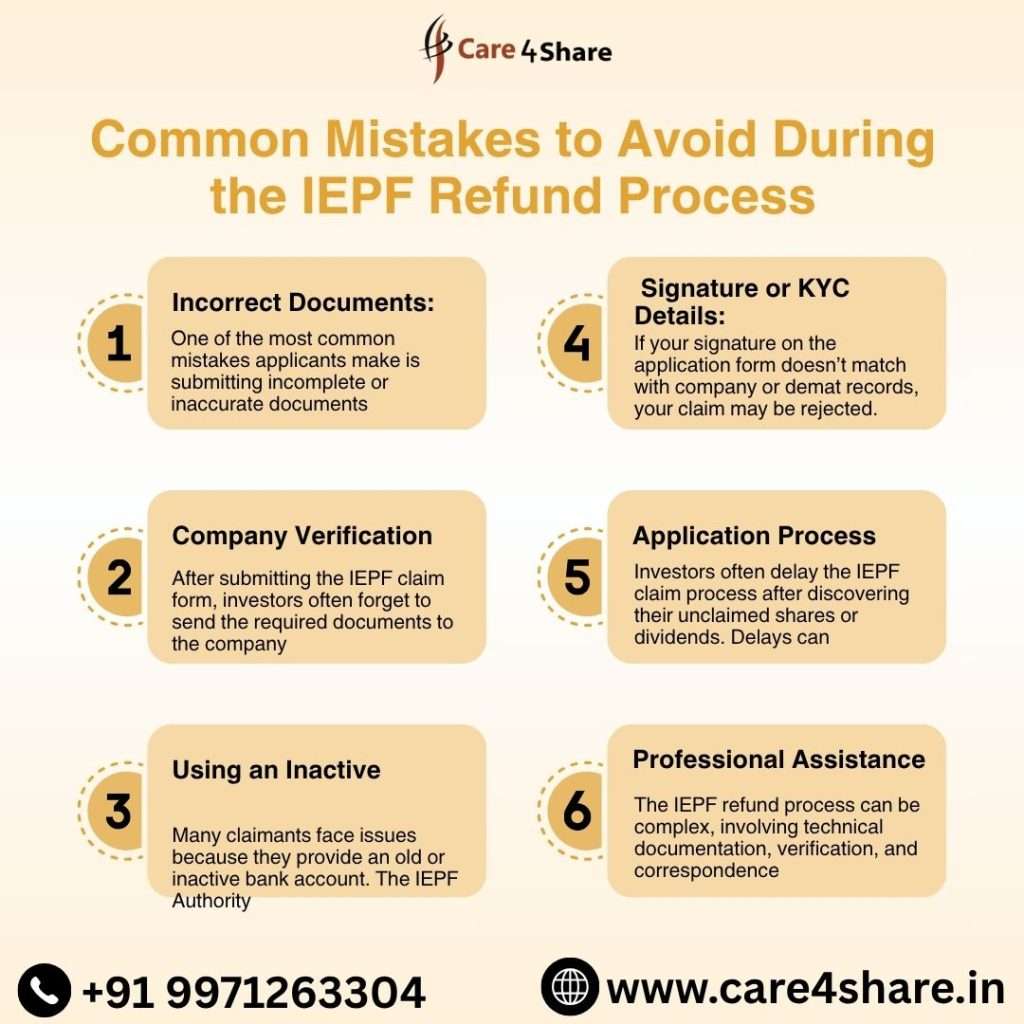

Common Mistakes to Avoid During the IEPF Refund Process

Avoid these common errors to ensure your claim isn’t delayed or rejected:

Entering the wrong Folio Number or CIN

Failing to send physical documents to the company

Uploading unclear or unreadable documents

Missing NOC or heirship proofs in legal cases

Assuming the refund happens automatically (you must apply)

How to Track IEPF Claim Status

You can easily track your claim’s progress online:

Visit the IEPF SRN Tracking Portal

Enter your SRN (Service Request Number)

The system will show real-time status such as:

Pending with Company

Pending with IEPF Authority

Approved

Rejected (with reason)

What If the Company Is Not Responding?

Sometimes, companies delay or ignore verification. In such cases:

Send a reminder email/post to the Nodal Officer

Lodge a complaint on the MCA portal

Contact the IEPF Authority directly

If unresolved, take help from professional share recovery services like Care4Share

How Care4Share IEPF Experts Help You

The IEPF refund process can feel complex — forms, documents, legal proof, and follow-ups. That’s where Care4Share IEPF experts come in.

We provide complete share recovery services to help you get your unclaimed dividends refund and recover unclaimed shares without stress.

Why Choose Care4Share?

- Expertise in handling complex IEPF cases

Assistance for legal heirs and nominees

Drafting of indemnity bond and affidavits

Liaison with company Nodal Officers & IEPF Authority

Fast, transparent, and reliable recovery process

Whether it’s Nidhi company shares, public company shares, or mutual fund dividends — Care4Share ensures your investments return to your hands.

📞 Call us: +91 9971263304

📧 Email: care4share.main@gmail.com

FAQs About Recovering Unclaimed Shares from IEPF

Q1. What if my shares are more than 10 years old?

You can still claim them through the IEPF Form 5 process — there’s no expiry period for claiming rightful shares.

Q2. How long does the IEPF refund process take?

Usually, it takes 3–6 months, depending on document verification and company response time.

Q3. Can I claim both shares and dividends together?

Yes. If both were transferred to IEPF, you can recover them in one single claim.

Q4. Do I have to pay any government fee?

No, the IEPF Authority does not charge any claim fee.

Q5. Can Care4Share help legal heirs recover shares?

Absolutely! Care4Share specializes in helping legal heirs recover shares and dividends through documentation and legal guidance.

Conclusion

Unclaimed shares or dividends may seem like lost money, but the truth is — they can be recovered anytime with the correct steps. The IEPF refund process ensures that every rightful investor can reclaim their investment securely and transparently.

So, if your Nidhi company shares have been transferred to IEPF, take action today. With expert help from Care4Share IEPF experts, you can recover unclaimed shares, get your unclaimed dividends refund, and restore your wealth without complications.

Don’t let your money stay lost — reclaim it today with Care4Share!