INTRO

Recovering unclaimed dividends and shares from the Investor Education and Protection Fund (IEPF) is a powerful step toward reclaiming your rightful financial assets. However, many investors unknowingly make mistakes that can delay or derail the process. Whether you’re an original shareholder or a legal heir, knowing the right process and avoiding common errors will significantly improve your chances of a successful claim. This guide focuses on helping you avoid pitfalls while trying to recover unclaimed dividends and shares from IEPF.

What is IEPF?

IEPF stands for Investor Education and Protection Fund. It was established under Section 125 of the Companies Act, 2013, to safeguard investors’ unclaimed dividends, matured deposits, debentures, and shares. If dividends remain unclaimed for seven consecutive years, the shares and dividends are transferred to IEPF.

To recover unclaimed dividends, the rightful shareholder or legal heir must file an application using Form IEPF-5, submit physical documents to the company, and comply with guidelines.

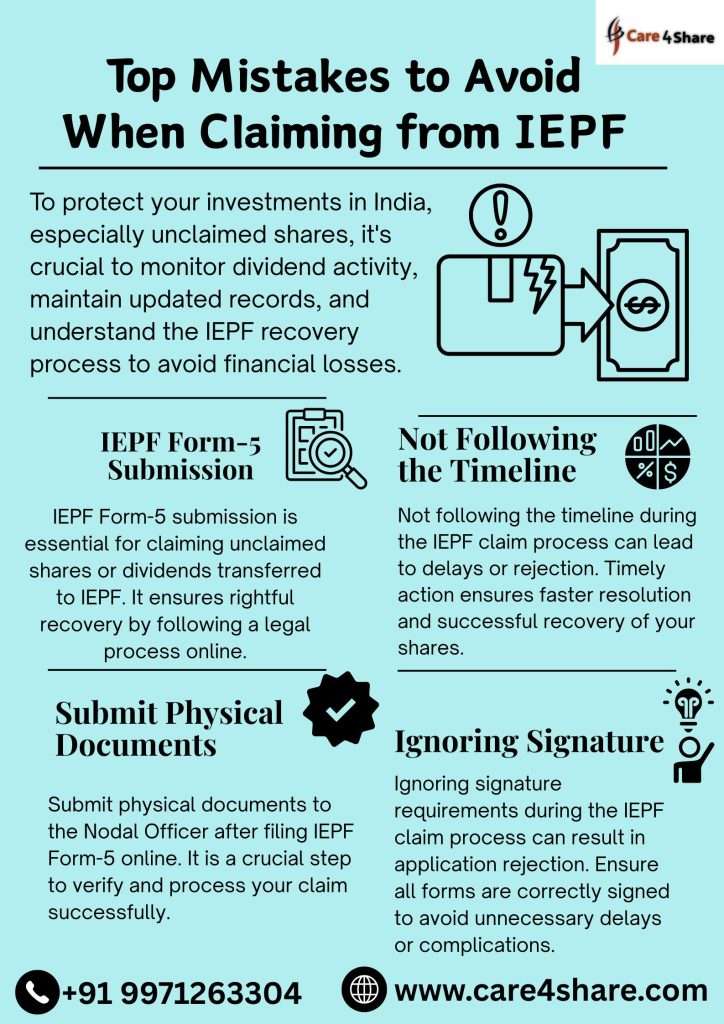

Top Mistakes to Avoid When Claiming from IEPF

1. Incomplete or Incorrect IEPF Form-5 Submission

One of the most frequent mistakes people make when trying to recover unclaimed dividends is filling out Form IEPF-5 incorrectly. Errors such as mismatched folio numbers, missing PAN details, and typos can cause rejections.

Avoid it by:

- Carefully reviewing personal and shareholding information

- Verifying DP/Client ID, folio, and company name

- Matching the bank account details with a valid proof like a cancelled cheque

2. Failure to Submit Physical Documents to the Company

Completing the online Form IEPF-5 is only half the battle. If you don’t send the physical copy of the claim with all supporting documents to the company’s Nodal Officer, your claim won’t be processed.

Avoid it by:

- Printing the filled IEPF-5 form

- Attaching documents like Aadhaar, PAN, client master list, cancelled cheque, and original share certificate

- Sending all documents via speed post or courier with acknowledgment

3. Not Following the Timeline

Timely action is crucial. Many people delay submitting documents or responding to communication from the company.

Avoid it by:

- Sending documents within 7–15 working days of online submission

- Regularly checking your email or postal communication

4. Ignoring Signature Mismatch Issues

The IEPF authority and company compare your current signature with their records. A mismatch can lead to claim rejection.

Avoid it by:

- Getting your current signature attested by a notary or bank manager

- Providing an affidavit if you’re a legal heir or name has changed

5. Lack of Legal Heir or Succession Certificate

When trying to recover unclaimed dividends of a deceased shareholder, legal heirs often overlook the need for proper documentation.

Avoid it by:

- Obtaining a succession certificate or legal heir certificate

- Providing NOCs from other legal heirs if necessary

6. Incorrect Bank Details

Even a small mistake in your bank details can prevent the credit of dividends or shares.

Avoid it by:

- Providing a cancelled cheque with your printed name

- Double-checking IFSC and account numbers

7. Not Verifying Old Shareholding Records

Corporate actions like mergers or name changes can confuse the identity of the company whose shares you’re claiming.

Avoid it by:

- Checking the company’s current name and CIN on the MCA portal

- Verifying the historical shareholding through demat statements or old records

8. Failing to Track Claim Status

Submitting a claim is not the end. You must follow up.

Avoid it by:

- Using the IEPF tracking tool on the website

- Contacting the Nodal Officer if no update comes within 30–60 days

9. Ignoring Demat Conversion for Physical Shares

Some companies require physical shares to be converted to demat before processing the claim.

Avoid it by:

- Opening a demat account in your name

- Requesting conversion before initiating the IEPF process

10. Filing Duplicate Claims

People sometimes file the same claim multiple times, causing confusion.

Avoid it by:

- Keeping a record of filed claims and SRN numbers

- Waiting for a reply before resubmitting

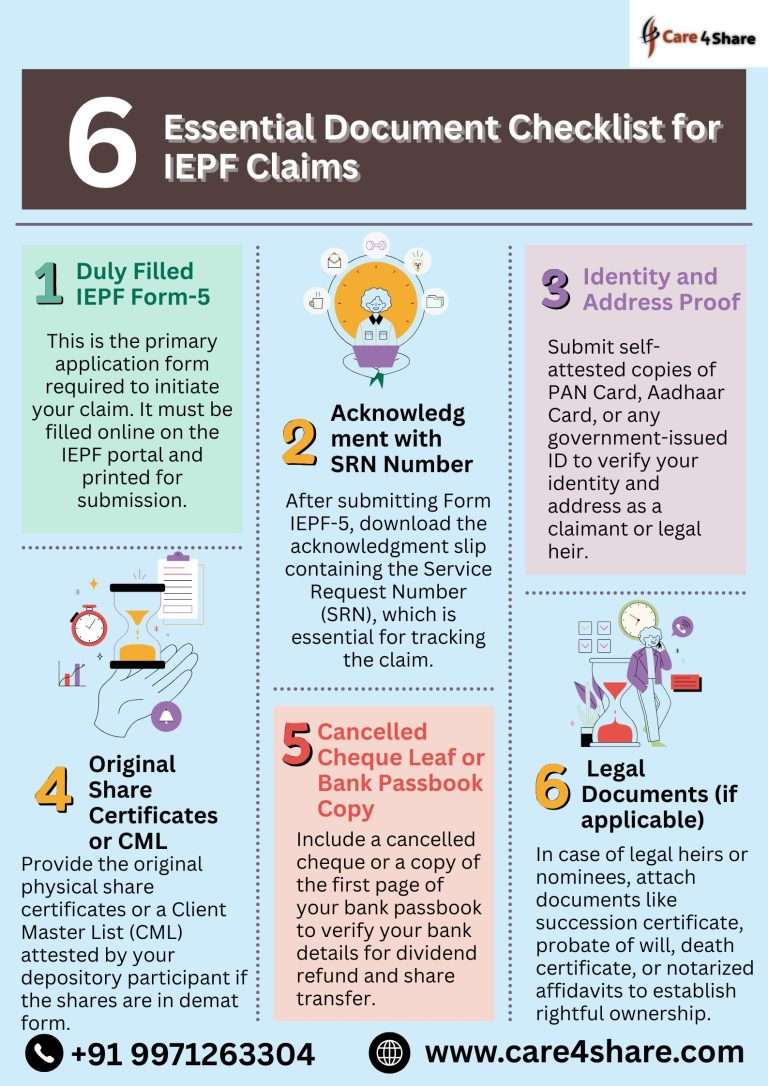

Essential Document Checklist for IEPF Claims

To recover unclaimed dividends smoothly, ensure the following documents are prepared:

- Copy of filled Form IEPF-5

- Acknowledgment from MCA

- PAN and Aadhaar copies

- Client Master List (if in demat)

- Cancelled cheque with printed name

- Signature verification letter from bank

- Legal documents if claiming as heir

- Share certificates (for physical shares)

🛠️ Pro Tips to Speed Up the Process

- Hire an experienced consultant

- Keep all KYC documents in one folder

- Ensure your demat and bank accounts are active

- Use speed post with tracking for document submission

- Keep file copies of everything submitted

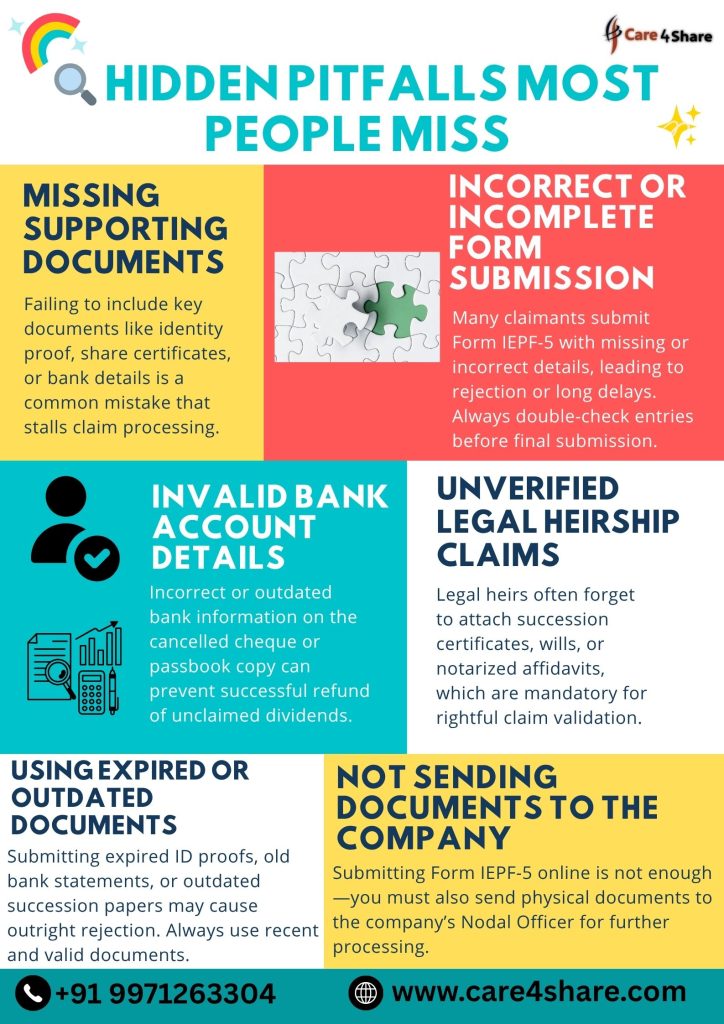

🔍 Hidden Pitfalls Most People Miss

1. Assuming Shares Are Already Transferred to IEPF

Some claimants begin the process without verifying whether the shares have actually been transferred to IEPF.

Avoid it by:

- Checking the company’s unclaimed dividend/share list

- Contacting the Nodal Officer for confirmation

2. Not Mapping Share Transfer History

If your shares have changed companies due to a merger or split, failing to map this can result in a failed claim.

Avoid it by:

- Tracing the company’s merger/acquisition history

- Reviewing old demat statements and share certificates

3. Overlooking Tax Obligations

Dividends and capital gains on recovered shares may be taxable.

Avoid it by:

- Consulting a Chartered Accountant

- Reporting recovered amounts in your ITR

4. NRI Investors Ignoring FEMA Compliance

NRIs must comply with FEMA rules while trying to recover unclaimed dividends.

Avoid it by:

- Using NRO/NRE accounts as applicable

- Submitting visa, passport, and OCI/PIO documents

5. Assuming RTA Will Follow Up Automatically

Don’t wait for updates—follow up!

Avoid it by:

- Creating a follow-up timeline

- Sending email reminders every 15–20 days

6. Uploading Low-Quality Scans Online

Low-resolution documents are a common reason for claim rejection.

Avoid it by:

- Scanning documents at 300 dpi in PDF format

- Naming files clearly (e.g., PAN_Card.pdf)

7. Missing Authority Letters in Joint/Legal Claims

Legal or joint claimants must submit authority letters or NOCs.

Avoid it by:

- Getting NOCs from joint holders or co-heirs

- Submitting an indemnity bond where required

8. Disregarding Company-Specific Requirements

Some companies have unique documentation policies.

Avoid it by:

- Checking company website or SOPs

- Reviewing their IEPF claim guidelines

9. Submitting Claims with Unlinked PAN-Aadhaar

Unlinked KYC can result in rejection.

Avoid it by:

- Linking PAN and Aadhaar beforehand

- Updating KYC with your bank and demat account

10. Depending Entirely on Consultants

Consultants help, but your oversight is crucial.

Avoid it by:

- Reviewing every submission yourself

- Asking for document copies and status updates

Final Thoughts: Be Proactive to Recover Unclaimed Dividends Successfully

Recovering unclaimed dividends and shares from IEPF is a valuable opportunity to reclaim lost wealth. However, a small oversight can derail the process. By understanding both the common and hidden mistakes, and maintaining a proactive, organized approach, you can ensure a smooth and successful recovery process.

Whether you’re an investor, heir, or consultant, always double-check documents, stay in contact with the company, and be mindful of timelines. Don’t let bureaucracy delay what is rightfully yours—start your journey to recover unclaimed dividends today!

Would you like this blog formatted as a downloadable PDF, or would you like SEO-friendly titles, meta descriptions, or social media captions created?

⚖️ Jurisdictional Confusion Between Company and IEPF Authority

Another overlooked issue is misunderstanding who handles what. Many claimants mistakenly expect the IEPF Authority to respond directly. However, it is the company and its RTA that do the heavy lifting, verifying documents, and forwarding your claim to IEPF.

📬 Mistakes in Postal Communication

Sending physical documents is a mandatory part of the claim process. But errors like using ordinary posts, sending to the wrong address, or omitting supporting enclosures can result in lost or rejected claims.

Avoid This By:

Always use India Post’s Speed Post or a reputable courier with tracking.

Retain the tracking receipt and delivery acknowledgment.

Include a checklist inside the envelope to ensure all documents are accounted for.

🧑⚖️ Legal Complications in Succession Cases

For legal heirs or nominees, the situation can become even more challenging if there is no proper succession planning. Heirs without a will, succession certificate, or nomination must navigate the legal system before even starting the IEPF process.

Avoid This By:

Applying for a probate or legal heir certificate in advance.

Using affidavits or indemnity bonds if succession documents aren’t available.

Getting NOCs from all legal heirs to avoid objections.

📇 Mistaking Folio Numbers or ISINs

If your shares are in multiple folios or have been split into different ISINs due to company restructuring, confusion is likely.

Avoid This By:

Matching folio numbers with old dividend statements or physical share certificates.

Logging into your demat account and downloading the Client Master Report.

Confirming the correct ISIN for each set of shares you’re claiming.

💼 Consultants Promising Guaranteed Results

Several private consultants or agents may offer guaranteed claim approval—often without verifying if your shares are even eligible. Trusting them blindly can lead to money loss or delayed claims.

How to Stay Safe:

Work only with IEPF-experienced legal consultants or SEBI-registered advisors.

Request a consultation and get your case evaluated first.

Ask for transparency in timelines, success rates, and document handling.

🔍 Not Checking the Status of Share Transfer to IEPF

Many people initiate the claim process assuming their shares are already transferred to IEPF, when in fact, they are still with the company or RTA.

To Avoid This:

Search for your name in the “Unclaimed Shares” list published by the company.

Email the company or RTA for confirmation.

Only proceed if your shares/dividends are listed as transferred to IEPF.

🧾 Failure to Maintain a Proper Claim File

Organizing your documents is key. One small error like submitting expired address proof or illegible signatures can cause unnecessary delays.

📂 Checklist for Efficient Documentation:

Keep digital and physical copies of every submitted document.

Label all documents clearly (e.g., “PAN.pdf” instead of “scan123.pdf”).

Make a separate folder for communications, receipts, and follow-ups.

🔗 Claim Rejection Due to Unlinked Aadhaar and PAN

Unlinked PAN and Aadhaar or incomplete KYC with your demat/bank accounts often lead to rejections—even if the rest of the application is correct.

How to Avoid:

Link your PAN and Aadhaar before starting.

Update KYC details in your demat and bank accounts.

Check name and date of birth uniformity across all documents.

🛠 When to Escalate Your Case

If your claim hasn’t moved in more than 90 days, it may be time to escalate.

Steps to Escalate:

Write to the company’s Compliance Officer or Nodal Officer.

If there is no response, write to the IEPF Authority at iepfa@nic.in with your SRN and communication proof.

Finally, think about using the SEBI SCORES portal to file a complaint.

🔚 Conclusion: Smart Strategy for IEPF Claims

✅ Checklist for Success:

Confirm shares/dividends are transferred to IEPF

Submit a correctly filled IEPF-5 Form

Send all required physical documents to the company

Verify KYC, signatures, and succession paperwork

Maintain a follow-up plan and a log of all connections.