Introduction

In today’s fast-paced financial world, many investors unintentionally lose track of their old investments. With frequent job changes, relocations, multiple demat accounts, forgotten physical share certificates, or unclaimed dividends, crores of rupees remain idle across banks, mutual funds, insurance policies, and companies. In India alone, there are now thousands of crores in unclaimed dividends and shares in the Investor Education and Protection Fund (IEPF).

If you’ve ever wondered whether you or your family have old investments lying unclaimed, you’re not alone. By recovering these assets, you can prevent wealth leakage, increase security, and fortify your financial portfolio. This guide displays how to keep track of your previous investments and shares, successfully recover them, and make sure you never get lost again.

Why Do People Lose Track

Before learning how to track, it’s important to understand why investments get lost in the first place. Common reasons include:

Job Changes & Multiple PF Accounts – Each job may open a new Provident Fund account, and many employees forget to transfer balances.

Relocation Without Updates – Shifting cities without updating KYC details often results in undelivered dividend warrants or policy communications.

Multiple Demat Accounts – Investors who switch brokers may forget older demat accounts, leaving shares idle.

Misplaced Physical Share Certificates – Paper-based investments from the pre-demat era often get lost or damaged.

Unlinked or Closed Bank Accounts – Dividends and interest payments fail when old accounts are inactive.

Lack of Awareness About Mergers/Delistings – Shares of merged or delisted companies confuse investors.

Death of an Investor Without Nomination – Families remain unaware of existing investments.

Poor Record-Keeping – No consolidated tracking of investments often leads to forgotten wealth.

These reasons highlight the importance of systematic tracking and modern digital tools for recovering old investments.

Tools and Methods to Track Old Investments

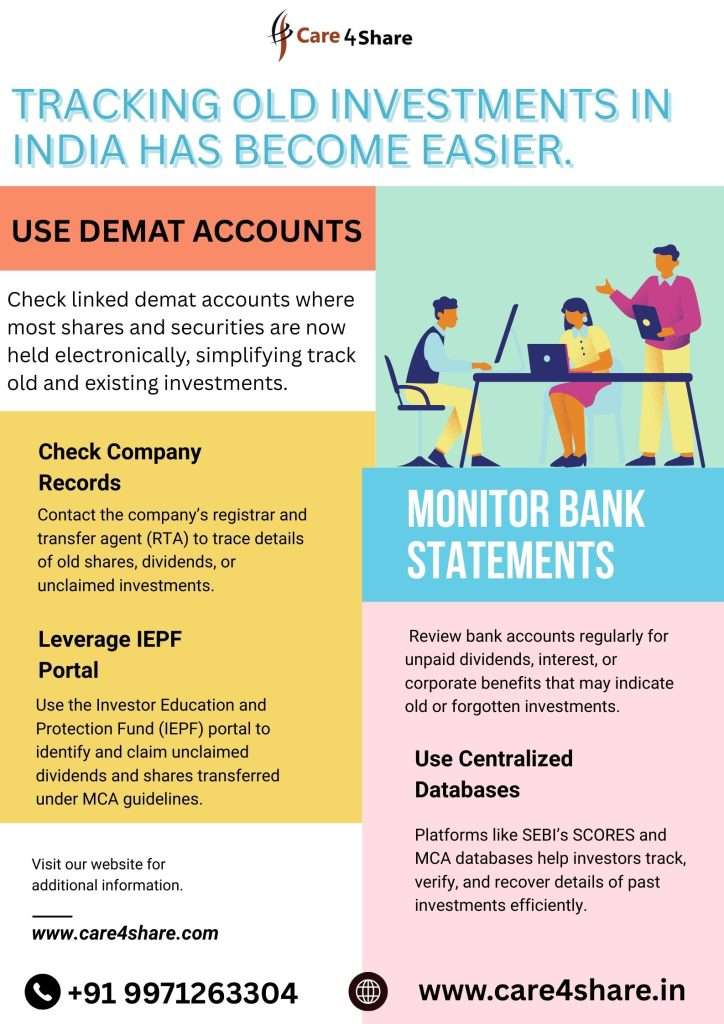

Tracking old investments in India has become easier due to technology, regulatory reform.

1. PAN-Based Investment Tracking

Almost all modern financial instruments are linked to PAN. Using PAN, you can check with:

NSDL & CDSL (for demat holdings).

CAMS & KFinTech (for mutual funds).

Bank & insurance portals.

2. Bank Statements and Passbooks

Check old statements for dividend credits, SIP deductions, or FD interest. Even small entries can lead to forgotten investments.

3. Demat Account Statements

Approach your Depository Participant (DP) to retrieve details of inactive demat accounts.

4. Registrar and Transfer Agents (RTAs)

CAMS, KFinTech, Link Intime, Skyline – maintain shareholder records.

Provide them with PAN, folio number, or old certificates to trace shares.

5. IEPF Website

The MCA IEPF portal allows you to search for unclaimed shares/dividends linked to your name and company.

6. EPFO Portal

Old provident fund balances can be tracked with UAN or by using past employer details.

7. IRDAI Portal for Insurance

Track unclaimed policies through insurance company websites or IRDAI’s centralized facility.

8. SEBI SCORES Portal

Raise complaints or request information about missing investments.

9. RBI Depositor Portal

Check for unclaimed fixed deposits and savings account balances from old banks.

10. Professional Assistance

In complex cases, hire a CA, financial advisor, or legal expert for recovery.

Role of IEPF in Recovering Old Shares

One of the most important tools for protecting unclaimed investor wealth is the Investor Education and Protection Fund (IEPF).

How it Works:

Dividends as well as shares are transferred to the IEPF if they are not claimed for seven years in a

Investors can reclaim them by filing Form IEPF-5 and submitting required documents.

Steps to Recover:

- Visit the IEPF website.

- Download and fill Form IEPF-5.

- Attach documents: PAN, Aadhaar, cancelled cheque, share certificates, client master list.

- Submit to the company’s nodal officer.

- After verification, IEPF credits the shares/dividends back.

- Many claims are rejected due to errors in form-filling, missing documents, or delays. Hence, accuracy is crucial.

Step-by-Step Guide to Recover Old Shares Here’s a simplified roadmap:

- Collect All Records – Old share certificates, folio numbers, PAN, bank statements.

- Verify with RTA – Contact the company’s registrar for details.

- Check IEPF Status – If shares are transferred, follow the IEPF process.

- File IEPF-5 – Carefully fill and upload online.

- Submit Documents – Send hard copies to the nodal officer.

- Verification of the Company: The company looks at and sends to IEPF.

- Approval & Credit – Shares/dividends credited back to your demat/bank.

Example: An investor recovered shares worth ₹15 lakh that were lying unclaimed since the early 2000s.

- Tracking Other Old Investments Beyond Shares

- Not just shares, several other investments often remain forgotten:

- Mutual Funds – Use CAMS & KFinTech consolidated statements.

- Fixed Deposits – RBI portal lists unclaimed FDs.

- PPF/NSC/KVP – Contact India Post or RBI.

- Insurance Policies – Track via IRDAI.

- Provident Fund (EPF) – Use UAN portal or EPFO grievance redressal.

- Bonds/Debentures – Approach respective RTAs.

- Real Estate Investments – State land records help verify property holdings.

- How to Avoid Losing Track of Future Investments

- Prevention is better than recovery. Follow these steps:

- Follow clear of multiple accounts and keep your demat account consolidated.

- Connect PAN and Aadhaar: Transparency is made sure through controlled tracking.

- Update KYC Regularly – Email, mobile, and bank details must be current.

- Use Nominee Facility – Nominate family members across all accounts.

- Digital Investment Tracker – Maintain Excel or use apps like ET Money, Zerodha Console, CAMS+.

- Annual Portfolio Review – Check and reconcile investments every year.

- Inform Family Members – Ensure awareness of your holdings.

- Expert Tips for Successful Recovery

- Keep multiple ID proofs ready (PAN, Aadhaar, Passport).

- Always cross-check details on forms before submission.

- Stay away from incorrect recovery agents and only use official channels.

- Take professional help for disputed cases.

- Keep a record file of recovery correspondence.

How to Track Your Old Investments and Shares: An Extended Guide

Losing track of old investments is a surprisingly common problem. While you may have already understood the basics of tracking shares, mutual funds, or provident fund accounts, there are still hidden corners of wealth recovery many investors overlook. This extended guide adds deeper insights, practical strategies, and expert suggestions to ensure you leave no stone unturned while reclaiming your investments.

Common Scenarios Where Investors Lose Track of Wealth

- Dormant Joint Accounts – Many old savings accounts were opened jointly. The account goes dormant when one holder tools or loses contact.

- Name Mismatches – Investors with initials, name changes after marriage, or spelling differences in KYC records often fail to link investments.

- Corporate Actions – Mergers, bonus issues, or stock splits can leave investors confused about their holdings if they don’t follow company announcements.

- Old Government Bonds & Certificates – Many families purchased savings bonds or NSCs decades ago and forgot to encash them.

- Inheritance Without Knowledge – Legal heirs are often unaware of investments made by parents or grandparents.

- 👉 Example: A Mumbai-based investor discovered 300 shares of a company worth ₹12 lakh in his late father’s name after tracing old bank statements.

- Digital Innovations Helping Investors Track Investments

- With the rise of FinTech platforms and government portals, tracking is much easier today than it was a decade ago.

- CKYC (Central KYC Registry): Allows investors to update KYC once and link across multiple financial products.

- CAMS+ Mobile App: Consolidates mutual fund folios, even from different AMCs.

- NSDL CAS (Consolidated Account Statement): Provides a unified view of shares, bonds, and mutual funds linked to your PAN.

- Investor Helpline by SEBI: Provides grievance redressal for lost or unclaimed securities.

- IRDAI “Bima Bharosa” Portal: A central platform for checking unclaimed insurance amounts.

- These digital tools act as investment detectives, connecting old scattered records to your PAN and Aadhaar.

- How Legal Heirs Can Track & Claim Old Investments

- When an investor passes away without leaving clear documentation, heirs can still recover investments with the right process:

- Verify Nomination: A proposed facility is present in the majority of financial assets. Nominees can claim with a death certificate and ID proof.

- Succession Certificate / Will – If no nominee is registered, a legal heir may need a succession certificate or probate of will.

- Affidavit & Indemnity Bonds – Companies and RTAs often ask legal heirs to provide affidavits for verification.

- Professional Help – In complex inheritance cases, consulting a lawyer or CA speeds up recovery.

- 👉 Pro Tip: Always register nominees in mutual funds, demat accounts, and bank deposits to avoid complications for your family.

Real-Life Success Stories of Tracking Old Investments

Many investors forget post office investments, especially if opened in rural or semi-urban branches.

- Best Practices to Stay Organized

- To ensure you never lose track of future investments:

- Create an “Investment Folder” – Maintain both physical and digital copies of certificates, folios, and account details.

- Link Email & Mobile Numbers – Always keep them updated to receive alerts.

- Perform Annual Wealth Audits: Examine and balance your assets annually.

- Inform Trusted Family Members – Share a simple investment tracker with your spouse/children.

- Use Cloud Storage – Save scanned investment proofs in secure online storage.

- Expert Tips to Track Old Investments Faster

- Always use PAN + Date of Birth when approaching RTAs or financial institutions.

- If your name changed, submit name-change proof (marriage certificate, gazette notification, etc.).

- Approach regional investor associations for guidance — they often assist with dormant investments.

- Avoid fraud recovery agents. Only deal through official portals like IEPF, EPFO, IRDAI, RBI.

- For shares transferred to IEPF, ensure Form IEPF-5 is filled carefully with updated bank and demat details.

Conclusion

Tracking your old investments and shares is not just about money — it’s about financial security, family inheritance, and peace of mind. With digital tools, PAN-based tracking, IEPF recovery processes, and professional guidance, reclaiming forgotten wealth has become simpler than ever.