INTRO

Latest Rules & Amendments in IEPF Claim Process (2025 Updates)

defending unclaimed dividends, old deposits, loans, and shares that investors have not yet claimed is one of the Investor Education and Protection Fund’s (IEPF) most crucial functions. yet claimed. After shares or dividends go unclaimed for seven years in a row, the business is required to give them to the IEPF Authority. Investors or their legal heirs then need to follow the IEPF claim process to recover their rightful investments. Over the years, the Ministry of Corporate Affairs (MCA) has introduced several reforms to simplify the claim procedure and make it more transparent. In 2025, fresh amendments and updates were introduced to streamline the claim system, reduce fraudulent claims, and speed up investor refunds. Let us explore the latest rules and amendments in the IEPF claim process (2025 updates) in detail.

Background of the IEPF Claim Process

The IEPF was set up to promote the interests of investors in accordance with Section 125 of the Companies Act of 2013. Also, if dividends are not claimed within seven years, the shares are transferred to the company.

Indeed, this process is usually attacked for being lengthy and complex, particularly for NRIs or legal heirs. The 2025 amendments aim to address these challenges by tightening compliance and enhancing digital transparency.

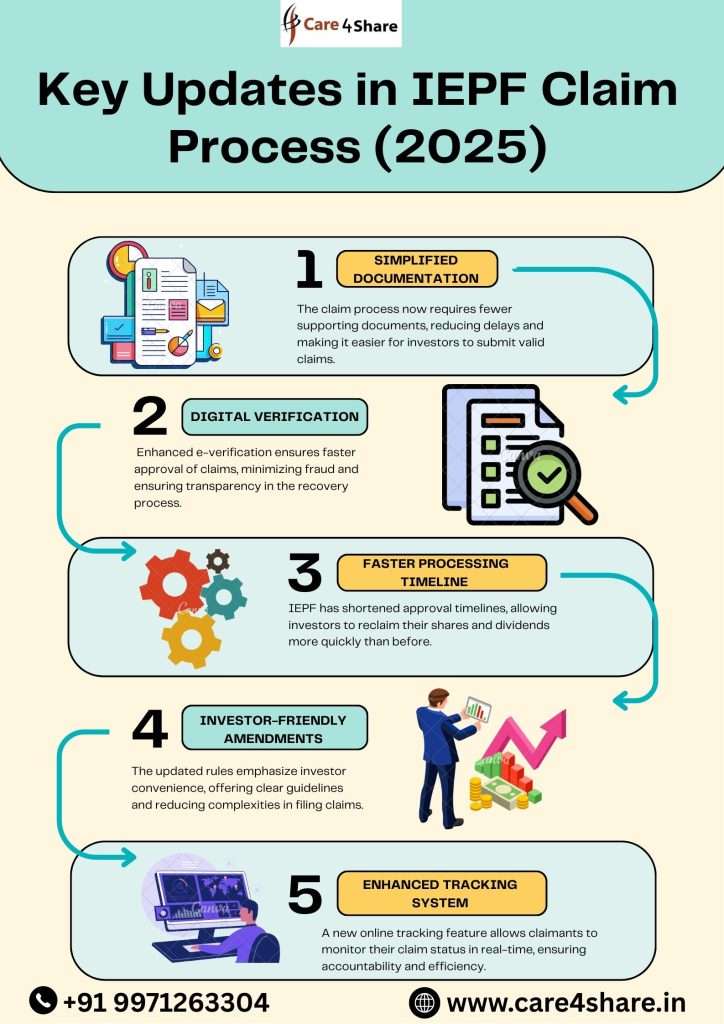

Key Updates in IEPF Claim Process (2025)

1. Mandatory Linking of PAN and Aadhaar for Claimants

From April 2025, investors must ensure their PAN and Aadhaar are linked before filing claims. This step aims to prevent identity fraud and duplication in the claim process. For NRIs, a valid passport and OCI/PIO card must be submitted instead.

Impact: This rule strengthens identity verification, reducing fraudulent claims.

2. Digitization of Claim Verification

In the past, documents had to be delivered in person to the company’s nodal officer. Now, under the new rules, claimants can upload digitally signed affidavits and indemnity bonds through the MCA portal. Physical verification is required only in exceptional cases.

Impact: This speeds the IEPF claim procedure and removes paperwork.

3. Revised Format of Indemnity Bond & Affidavit

The Ministry has issued a new standard format for indemnity bonds and affidavits, including mandatory notary and stamp duty specifications.The case of Claim must now comply with state-by-state stamp duty demands.

State-by-state stamp duty compliance has become a must of clients.

4. Timeline for Refunds Reduced

The IEPF Body is devoted to processing valid requests within 120 days, even though this may take longer than 180–240 days. Updates are now produced on its own by the system and sent to the claimant via SMS and email.

Impact: Investors can expect quicker refunds of shares and dividends.

5. Succession & Legal Heirship Simplified

For legal heirs, the requirement of a Succession Certificate or Probate of Will has been simplified. If the claim is below ₹5 lakhs, a Legal Heir Affidavit + No Objection Certificates (NOC) from other heirs will now suffice. For higher-value claims, succession proof is still mandatory.

Impact: Makes small-value claims faster and easier for families.

6. Nodal Officer Accountability Increased

Every company must designate a dedicated IEPF Nodal Officer who is directly responsible for verifying claimant documents within 30 days. Any delay must be reported to the IEPF Authority with valid reasons.

Impact: Faster response from companies and reduced claim pendency.

7. Mandatory Demat Account for Claim Settlement

All recovered shares will only be credited to the claimant’s Demat account starting in 2025. Physical share certificates will not be issued under any circumstance.

Impact: promotes digital preservation and removes the possibility of physical certificates being lost.

8. Tracking System Enhanced

The MCA has launched a revamped “IEPF Claim Status Tracker” where claimants can check real-time updates using their application number. Notifications on claim progress are also sent via email and SMS.

Impact: Increases transparency and helps claimants stay updated.

9. Penalty for Fraudulent Claims

To discourage fraud, strict penalties have been introduced. Any fraudulent attempt to claim shares will result in penalties up to ₹10 lakhs or imprisonment up to 5 years under the Companies Act provisions.

Impact: Ensures genuine claims are prioritized and fraudulent activity is minimized.

10. Professional Certification for Complex Claims

For claims involving joint shareholders, multiple heirs, or missing documents, a Chartered Accountant (CA) or Company Secretary (CS) certification is now required.

Impact: Ensures accuracy and credibility of claims.

Practical Challenges Still Faced

Despite the new amendments, certain challenges remain:

Delays from company nodal officers who fail to verify documents on time.

Awareness issues, as many investors are still unaware of the 7-year rule.

NRIs face extra hurdles due to notarization/apostille requirements.

Stamp duty variations across states complicate affidavit submissions.

This is why many investors still rely on professional help (legal and financial experts) to avoid mistakes.

Best Practices for Investors in 2025

Ensure KYC compliance (PAN, Aadhaar, Demat) before filing claims.

Use the latest affidavit and indemnity formats provided by MCA.

Always cross-check details like signature, bank account, and address with company records.

Keep a scanned copy of all documents before submitting.

In case of inheritance claims, collect NOCs from other heirs beforehand.

To prevent needless delays, track claims on a regular basis through the MCA portal.

Why These Amendments Matter

The 2025 updates to the IEPF claim process are investor-friendly and aligned with India’s push towards digitization. They aim to:

Reduce delays in refund processing.

Prevent fraud and duplication.

Simplify inheritance claims for families.

Ensure all settlements happen via Demat, making the system safer.

These changes build more trust in the system and encourage investors to claim their rightful assets without hesitation.

1. Priority Processing for Senior Citizens & Widows

One of the most progressive steps in the 2025 amendments is the fast-track claim mechanism for senior citizens, widows, and differently-abled investors.

Such claims will now be processed on a priority basis, reducing delays.

This ensures vulnerable groups do not face unnecessary hurdles in recovering their investments.

Impact: Faster financial relief for those who need it the most.

2. Reduced Role of Physical Stamp Duty

Earlier, affidavits and indemnity bonds required physical stamp duty payment, which varied across states and caused confusion. Now:

MCA allows central digital stamp duty in states without e-stamp setup.

MCA accepts central digital stamp duty in states without an e-stamp facility.

Impact: equality, ease, and less burden of compliance.

3. Digital Ledger for Claim History

Another remarkable amendment is the launch of a digital claim ledger.

Claimants can now view past applications, current status, approvals, and refunds in one place.

It also removes duplicate claims and guarantees total openness.

Impact: Investors have a clear, trackable digital history of their claims.

4. Multiple Claims Allowed in One Application

Previously, investors had to file separate claims for each dividend or share transfer, creating unnecessary paperwork. Under the 2025 amendments:

Claimants can now club multiple claims from the same company into a single application.

This reduces both time and cost for claimants.

Impact: Simplified process, less documentation, and faster settlement.

5. Auto-Rejection of Incomplete Claims

To minimize delays caused by incomplete or incorrect submissions, MCA has introduced an auto-rejection feature.

Claims with mismatched details, missing KYC, or incorrect documents are rejected within 30 days.

Claimants receive an automatic notification to reapply correctly.

Impact: Reduces backlog and ensures only valid claims move forward.

6. Annual Reporting by Companies

To strengthen accountability, every company must now file an annual IEPF report with details of:

Total unclaimed dividends and shares transferred.

Pending claims and verification timelines.

Impact: Improved transparency and better monitoring of corporate responsibility.

7. Video-Based KYC for NRIs

NRIs have always faced additional challenges due to embassy notarization and apostille requirements. The new rule introduces:

KYC (Know Your Customer) verification via video for NRI seekers.

This allows them to complete KYC securely through digital video verification.

Impact: Global investors can make claims more quickly, easily, and easily.

8. Centralized Grievance Redressal System

A new centralized online grievance portal has been launched by MCA:

Claimants can raise complaints about delays, rejections, or company negligence.

The portal connects directly to the IEPF Authority for fast resolution.

Impact: Improves investor trust and nodal officers’ duty of care.

9. Integration with Banks for Direct Refunds

Earlier, dividend refunds often faced banking delays or errors in transfers. Now:

In order to make direct NEFT/RTGS payments, MCA has linked the IEPF system with banks.

Only the client’s related bank account receives payment.

Impact: Eliminates delays, errors, and ensures funds reach the right person.

10. E-Sign Facility for Faster Authentication

There were major holdups because indemnity bonds and paperwork needed to be physically signed. Under the new rules:

Investors can now use Aadhaar-based e-sign for authentication.

This replaces manual signatures, notaries, and courier submissions.

Impact: speeds up and completely removes paper in the IEPF claim process.

Why These Amendments Matter

The latest rules & amendments in IEPF claim process (2025 updates) reflect India’s growing focus on digitization, transparency, and investor protection.

Senior citizens and widows get priority support.

NRIs benefit from video-based KYC.

Investors save time with multiple claims in one application.

Transparency improves through digital ledgers and company reporting.

Faster refunds are ensured through bank integration and e-sign facilities.

Together, these reforms simplify a once lengthy and complicated process, ensuring that investors and their families can recover unclaimed dividends and shares with ease.

These changes have had a major impact on the IEPF claim process in 2025. From digital innovations like e-sign and video KYC to supportive measures for senior citizens, widows, and NRIs, the government is pushing for a faster, fairer, and more transparent system.

For investors, this means:

✔️ Reduced delays

✔️ Better transparency

✔️ Stronger fraud prevention

✔️ Faster refunds directly in bank accounts

The latest rules & amendments in IEPF claim process (2025 updates) are a big step towards empowering investors and ensuring their rightful wealth returns to them smoothly.

Conclusion

The latest rules and amendments in the IEPF claim process (2025) have made the procedure faster, more transparent, and secure. From mandatory PAN-Aadhaar linking to digitized affidavits, simplified heir claims, and improved refund timelines, the government has addressed key bottlenecks faced by investors.