INTRO

When it comes to the world of investments in India, two terms often confuse investors – IPO refunds and IEPF claims. Both deal with investors’ money that remains unclaimed, but they operate in entirely different contexts. Many investors who participate in Initial Public Offerings (IPOs) end up with unclaimed refunds due to technical issues, while others lose track of their dividends and shares over the years, which eventually get transferred to the Investor Education and Protection Fund (IEPF).

This detailed blog will help you understand the difference between IPO refunds and IEPF claims, how each process works, common reasons for delays, and the step-by-step process to recover your money. If you are someone who has invested in shares or IPOs in the past, this guide will clear your doubts and help you safeguard your investments. Understanding the Basics: IPO Refunds and IEPF Before we dive into the differences, let us first understand what these terms mean.

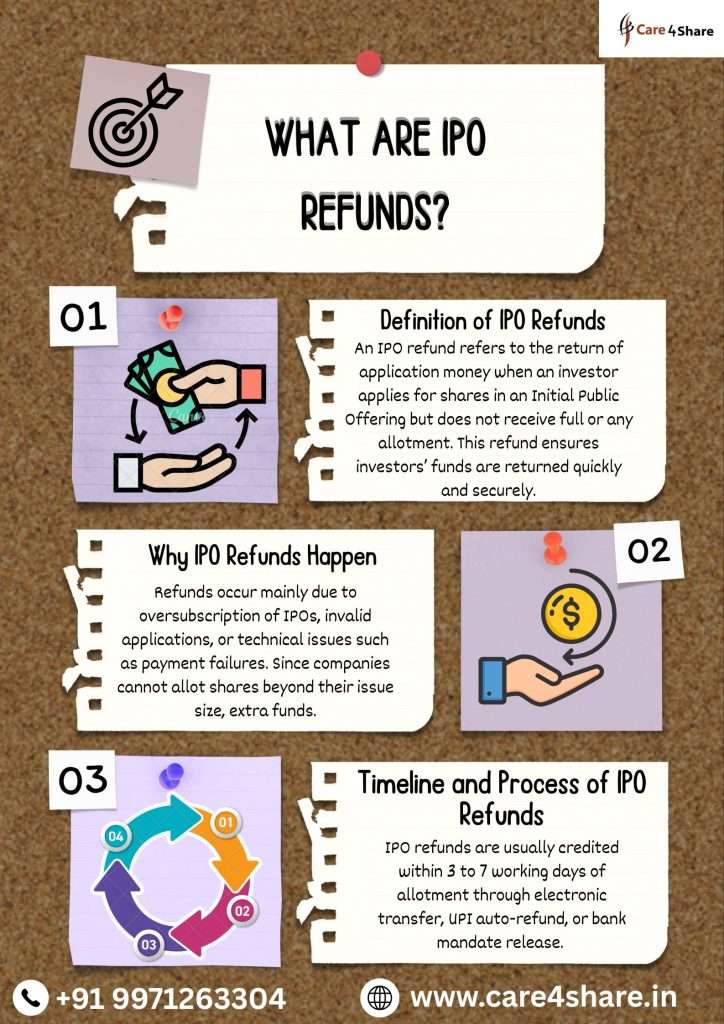

What are IPO Refunds?

Customers apply for shares by blocking or paying money when a company opens its public offering (IPO).

However, if the shares are not allotted fully (or at all), the balance amount is refunded to the investor.

For example:

- Suppose you applied for 100 shares worth ₹1,00,000 in an IPO.

- You were allotted only 20 shares worth ₹20,000.

- The remaining ₹80,000 will be refunded to you.

- This refund is known as the IPO refund.

What is IEPF?

The Investor Education and Protection Fund (IEPF) is a fund established by the Government of India under the Ministry of Corporate Affairs (MCA). If dividends, shares, or deposits remain unclaimed for 7 consecutive years, they are transferred to the IEPF.

For example:

- If you owned shares of a company but did not claim dividends for 7 years, those shares and dividends are transferred to IEPF.

- By making a claim to the IEPF Authority, you can then receive them back.

Key Differences Between IPO Refunds and IEPF Claims Here’s a quick comparison of IPO refunds vs IEPF claims:

- Feature

- IPO Refunds

- IEPF Claims

- Nature

- Money refunded for unallotted IPO shares

- Recovery of unclaimed dividends/shares after 7 years

- Timeframe

- Immediate (within a few days of IPO allotment)

- Long-term (after 7 years of inactivity)

- Authority Involved

- Registrar to the Issue, Banks, Stock Exchanges

- Ministry of Corporate Affairs (MCA) – IEPF Authority

- Process

- Automatic refund through ASBA/bank transfer

- Manual claim process with documents

- Common Issues

- Wrong bank details, failed transactions, delayed refunds

- Lost share certificates, outdated KYC, name mismatch

- Recovery Time

- Usually 7–10 working days

- Several months, depending on verification

Why Do IPO Refunds Happen? IPO refunds are common due to:

- Oversubscription of IPO – Demand exceeds supply, so only partial shares are allotted.

- Invalid Application – Mistakes in PAN, DP ID, or bank details.

- Technical Errors – Banking system failures or UPI payment glitches.

- Withdrawal or Rejection – If the IPO is withdrawn or your application is rejected.

- Refunds are usually processed automatically within 7–10 working days via:

- UPI mandates

- ASBA bank accounts

- NEFT/RTGS transfers

Why Do IEPF Claims Arise?

- When holders do not claim their dividends or shares, IEPF claims occur. Common reasons include:

- Change of Address – Investors shifted homes but did not update records.

- Name Mismatch – Especially in case of marriage or spelling errors.

- Lost Certificates – Physical share certificates misplaced.

- Unaware Legal Heirs – Family members unaware of deceased investor’s holdings.

- Inactive Accounts – Dividends remained unclaimed for 7 years.

- In this case, the business, in line with the Companies Act of 2013, transfers unclaimed shares or dividends to the IEPF.

- Process of Getting IPO Refunds Here’s how IPO refunds work: Application through ASBA/UPI

- Money remains blocked until allotment.

- Allotment Process

- If shares are not allotted, money is released.

- Refund Credit

- Automatically credited back to your bank account.

- 👉 If refund is delayed: Contact the Registrar to the Issue.

- Approach your bank or broker.

- File a complaint with SEBI SCORES portal if unresolved.

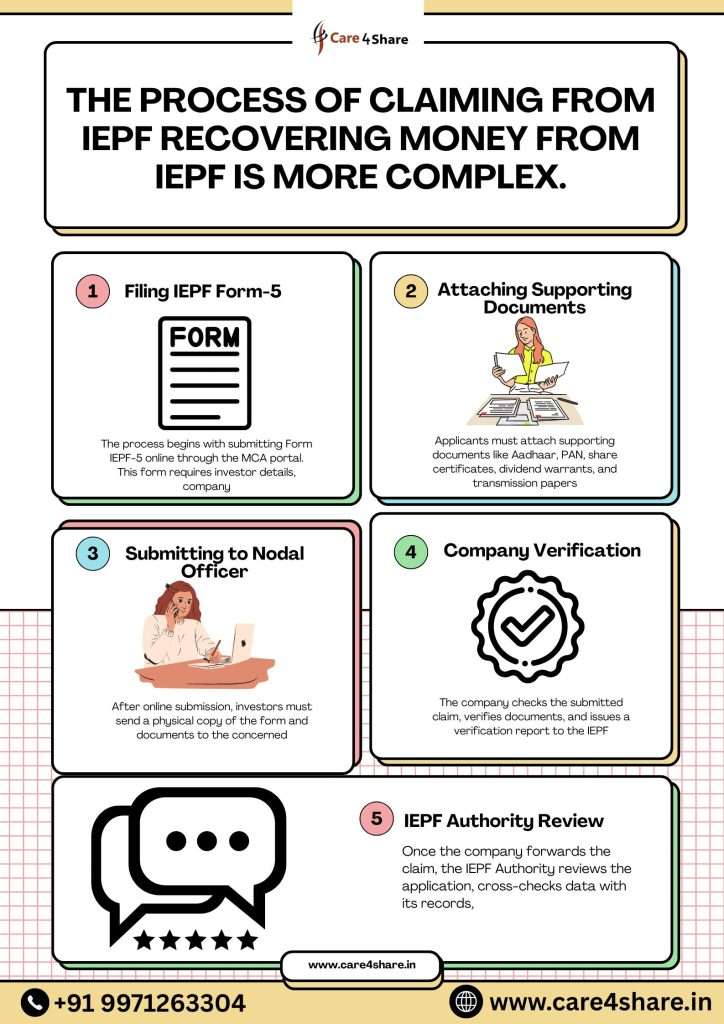

The process of Claiming from IEPF Recovering money from IEPF is more complex.

Practical Example

Step 1 – Filing the IEPF Claim Form

Complete Form IEPF-5, which can be found on the MCA website.

Step 2 – Submission to Company

Send physical documents (share certificates, indemnity bond, proof of identity, etc.) to the company’s Nodal Officer.

Step 3 – Verification by Company

After verifying your claim, the company sends it to the IEPF Authority.

Step 4 – IEPF Authority Approval

If verified, IEPF refunds dividends or transfers shares to your Demat account.

- 👉 Timeframe: The process can take 3–6 months depending on documentation.

- Common Challenges Investors Face In IPO Refunds UPI payment failures.

- Refund credited to the wrong bank account.

- Delays due to banking holidays.

- In IEPF Claims Lengthy paperwork.

- Delay in verification by companies.

- Multiple heirs claiming the same shares.

- Court approvals needed in disputed cases.

- IPO Refund Example: Ravi applied for ₹50,000 in a popular IPO but received no allotment. His refund was automatically credited to his bank account in 5 days.

- IEPF Claim Example: Meera’s father had shares of a company but never claimed dividends for 8 years. The shares went to IEPF. Meera had to file IEPF-5, submit succession documents, and wait 5 months before receiving the shares back.

- Investor Tips to Avoid Problems For IPO Refunds:

- Always double-check bank details and PAN.

- Track IPO allotment and refunds on registrar websites.

- Use reliable UPI IDs linked to bank accounts.

For IEPF Claims:

Keep KYC details updated with companies and banks.

Track dividends and corporate announcements.

Inform family about your investments to avoid future legal disputes.

Conclusion

While IPO refunds and IEPF claims both deal with investors recovering their money, they differ in process, timeline, and authority. IPO refunds are quick and mostly automated, while IEPF claims are lengthy, document-heavy, and require government approval.

For a safe investment journey, investors must keep their information updated, track refunds, and monitor dividends regularly. Being proactive can help avoid unnecessary delays and ensure your hard-earned money never goes unclaimed.

In short: IPO refunds are short-term and technical, while IEPF claims are long-term and legal in nature. You can protect the future of your money by being aware of both.

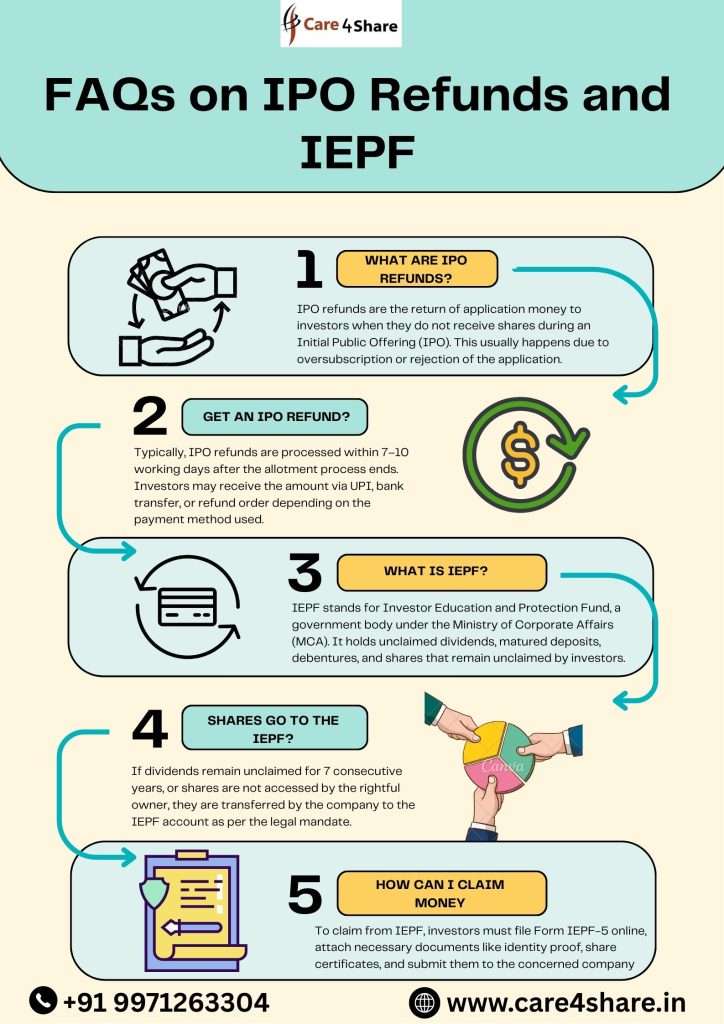

FAQs on IPO Refunds and IEPF

Q1. How long does an IPO refund take?

Usually 7–10 days after allotment finalization.

Q2. Can IPO refunds fail?

Yes, if bank details are incorrect or the UPI mandate fails.

Q3. How long does an IEPF claim take?

Depending on document quality and verification, it may take three to six months.

Q4. Can legal heirs claim IEPF shares?

Yes, by providing a succession certificate, will, or probate documents.

Q5. Does the same body handle IEPF claims and IPO refunds?

No. IPO refunds are handled by registrars/banks, while IEPF is managed by the MCA.