INTRODUCTION

Every year, thousands of Indian investors lose access to their investments — including shares, dividends, matured deposits, debentures, bonus shares, and mutual fund units. Reasons vary from outdated addresses, inactive folios, signature mismatch, unclaimed dividends, or even the death of the shareholder.

As per Section 124 of the Companies Act, 2013, if dividends remain unclaimed for seven consecutive years, the company must transfer both the unclaimed dividends and the corresponding shares to the Investor Education and Protection Fund (IEPF).

The good news is:

With a proper IEPF Recovery process, you can legally reclaim all your lost shares and dividends by filing an IEPF-5 claim.

This comprehensive guide explains everything you need to know about IEPF Recovery, including:

- Expert tips to avoid delays

- Common reasons for rejection

- Processing timelines

- Required documents

- Step-by-step recovery procedure

- Eligibility to file a claim

- Why shares are transferred to IEPF

- What is IEPF?

- How professional help can speed up the process

What Is IEPF Recovery?

IEPF Recovery is the official process through which investors or their legal heirs reclaim unclaimed:

- Equity shares

- Dividends

- Bonus shares

- Split shares

- Debentures

- Matured deposits

- Mutual fund units

Once transferred to IEPF, the shares remain frozen until the rightful claimant files a refund application through the IEPF-5 online form.

IEPF holds shares from companies like:

- HZL (Hindustan Zinc)

- Infosys

- Tata Steel

- Tata Motors

- Reliance Industries

- ITC

- HDFC Bank

- ICICI Bank

…and more than 5,000 companies listed and unlisted.

Why Do Shares Get Transferred to IEPF?

Most investors are unaware that even small issues can result in their shares being moved to IEPF.

The most common reasons include:

1. Unclaimed Dividends for 7 Years

If dividend remains unclaimed for seven consecutive years → shares transfer to IEPF.

2. Lost Share Certificates

If physical share certificates are lost, misplaced, or destroyed, dividends may not be processed.

3. Address Not Updated with the Company/RTA

If dividends or notices return undelivered, the company treats the folio as “inactive.”

4. Demat Not Done (Physical Shares)

Millions of shareholders still hold old paper certificates. These are highly prone to transfer delays.

5. Death of Shareholder

If transmission is not completed by legal heirs → dividends remain unclaimed → shares shift to IEPF.

6. Signature Mismatch

Signatures change over time; mismatch causes dividend rejection for years.

7. Outdated Email or Mobile Number

Shareholders stop receiving corporate communication, leading to inactivity.

8. Bank Account Closed / Merged

Dividend ECS fails → unclaimed status.

If the shareholder or their heirs do not correct these issues in time, the shares get transferred to IEPF after 7 years.

Who Can Claim IEPF Recovery? (Eligibility)

The following persons can file an IEPF refund application:

✔ Original Shareholder

✔ Nominee registered with the company

✔ Legal Heir / Successor

✔ Joint Holder

✔ Guardian in case of minors

In legal heir cases, transmission proof is mandatory before the IEPF refund can be released.

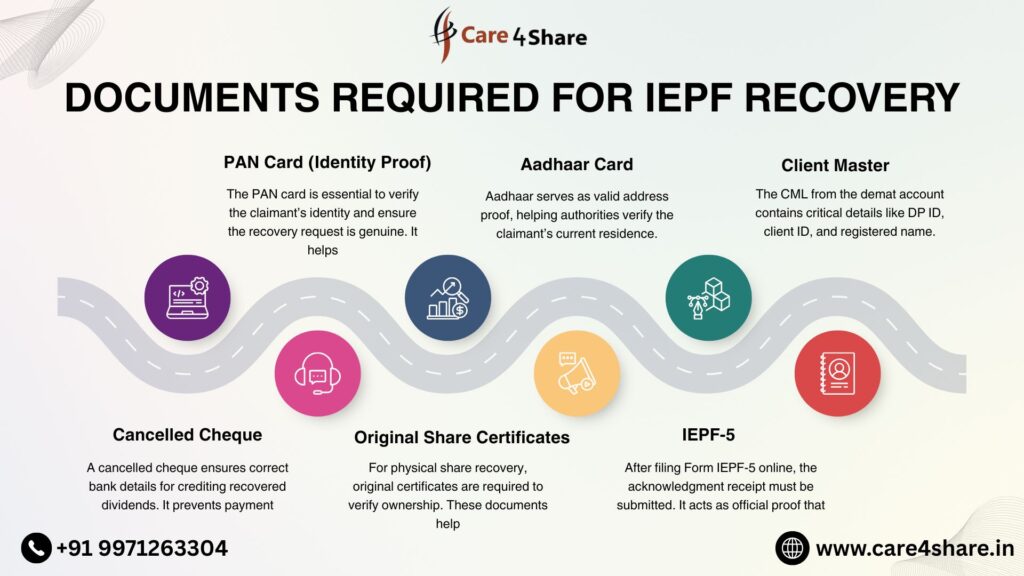

Documents Required for IEPF Recovery

The documentation varies depending on the situation (single holder, joint holder, or legal heir).

Mandatory Documents for All Applicants

- PAN Card

- Aadhaar Card

- Cancelled cheque (same name as shareholder/claimant)

- Client Master List (CML) from your demat account

- Self-attested KYC documents

- IEPF-5 form printout

- SRN acknowledgment

- Company request letter

If Physical Share Certificate Exists

- Original share certificate

- A duplicate share certificate in case the original was lost

- FIR copy (for loss cases)

- Indemnity & surety bonds

Legal Heir / Nominee Cases

- Death certificate of shareholder

- Succession certificate / legal heir certificate / probate

- Notarized affidavit

- Transmission request form

- Deed of indemnity

- Joint affidavit (if multiple heirs)

Legal heir cases are time-consuming and need accurate documentation.

Need expert help with IEPF Recovery? Visit our Contact Page: https://care4share.in/contact-us

Step-by-Step IEPF Recovery Process (2025 Updated Guide)

Below is the latest and most accurate process to recover your IEPF shares successfully.

Step 1 — File the IEPF-5 Form Online

Visit the IEPF website:

👉 www.iepf.gov.in

Fill details such as:

- Company name

- CIN (Corporate Identification Number)

- Folio or demat number

- Number of shares

- Dividend year-wise details

- Aadhaar and PAN

- Bank details

Once submitted, the system generates an SRN (Service Request Number).

Step 2 — Print the IEPF-5 Form & Attach Documents

Take a printout of:

✔ IEPF-5 form

✔ SRN acknowledgment

Attach:

- ID proofs

- Demat CML

- Cancelled cheque

- Address proof

- Share certificates (if any)

Arrange everything neatly.

Step 3 — Send the Document Set to the Company / RTA

Courier all documents to the company’s Nodal Officer or RTA (Registrar & Transfer Agent).

Some common RTAs:

- KFin Technologies

- Link Intime

- MAS Services

- Alankit Assignments

- Bigshare Services

Ensure you use a speed post or courier for tracking.

Step 4 — Company Verifies & Forwards the Claim to IEPF

The company checks:

- Signature

- KYC

- Demat details

- Past dividend records

- Transmission status (in their cases)

- Certificate authenticity

Timeline: 30–60 days

After verification, company sends a report to the IEPF Authority.

Step 5 — IEPF Authority Approves and Refunds

IEPF Authority processes the claim:

✔ Shares → transferred directly to your demat account

✔ Dividends → credited to your bank account

Processing Time:

- Simple cases: 45–90 days

- Legal heir cases: 90–180 days

Complicated disputes: 6 months or more

For official updates, visit the IEPF Government Portal: https://www.iepf.gov.in

Common Mistakes That Cause IEPF Claim Rejection

Most applications are rejected due to simple errors:

- Name mismatch in documents

- Wrong demat account details

- Signatures not matching RTA records

- Missing CML or bank details

- Incorrect dividend information

- Documents not notarized

- Death certificate not submitted in legal heir cases

- Transmission not completed

- Physical certificate errors

- Even one mistake can delay the case by months.

How to Avoid Delays and Rejections? (Expert Tips)

✔ Ensure demat details are correct

✔ Match signatures with RTA records

✔ Attach CML with ISIN clearly visible

✔ Provide correct year-wise dividend details

✔ Complete transmission before filing heir claims

✔ Don’t send photocopies — use notarized documents

✔ Keep mobile/email active for OTP verification

✔ Avoid overwriting on IEPF-5 form

Professional handling can reduce your processing time significantly

Why Professional Assistance Helps You Get Faster Approval

IEPF cases involve:

- Legal paperwork

- Transmission

- Notary/affidavits

- Company coordination

- RTA documentation

- IEPF follow-up

Most people struggle doing this alone.

Professional consultants ensure your file is error-free, complete, and processed faster.

We Help With:

✔ IEPF-5 filing

✔ Transmission for legal heirs

✔ Duplicate share certificates

✔ Signature mismatch resolution

✔ Affidavits & notary

✔ RTA follow-ups

✔ IEPF Authority coordination

✔ Case progress tracking

Success Rate: 98%+

📞 Call/WhatsApp: 098738 82177

Frequently Asked Questions (FAQ)

1. How long does an IEPF refund take?

Typically 45–90 days. Legal heir cases may take 3–6 months.

2. Can I recover shares without a certificate?

Yes, through a duplicate share certificate process.

3. Can a legal heir claim shares?

Absolutely, with proper documents like a death certificate and succession proof.

4. Is the IEPF filing free?

The online form is free, but other charges apply (notary, affidavits, courier).

5. What if my name is different on PAN and share records?

You must correct the mismatch before filing.

6. Can NRI shareholders claim IEPF recovery?

Yes, but additional documents like passport, OCI/PIO, foreign address proof may be required.

Final Word

IEPF recovery can feel complicated due to legal, technical, and documentation requirements.

But with the right guidance and a properly prepared file, you can easily recover your:

✔ Shares

✔ Dividends

✔ Bonus shares

✔ Split shares

✔ Deposits

Whether you are the shareholder, nominee, or legal heir, this guide gives you the complete roadmap to recover what is rightfully yours.

If you want a smooth, fast, and guaranteed process, professional assistance is always recommended.