Introduction

Every year, thousands of investors forget to claim their dividends, matured deposits, debentures, or shares. As per law, such unclaimed amounts are transferred to the Investor Education and Protection Fund (IEPF), managed by the Ministry of Corporate Affairs (MCA). To recover these amounts, shareholders or their legal heirs need to apply for a refund.

What is IEPF Refund?

The Investor Education and Protection Fund (IEPF) was created under Section 125 of the Companies Act, 2013. When dividends, matured deposits, debentures, or shares remain unclaimed for 7 consecutive years, they are transferred to IEPF.

To claim back these shares or dividends, investors must apply through Form IEPF-5 with supporting documents. Submitting the correct set of documents required for IEPF refund is the most critical part of the process.

Why are Documents Important for IEPF Refund?

The IEPF Authority ensures that only genuine investors or legal heirs receive the refund. This prevents fraud, duplication, or wrongful claims. Submitting incomplete or incorrect documents often leads to delays or rejection.

Therefore, having a clear checklist of documents required for IEPF refund is essential before filing your application.

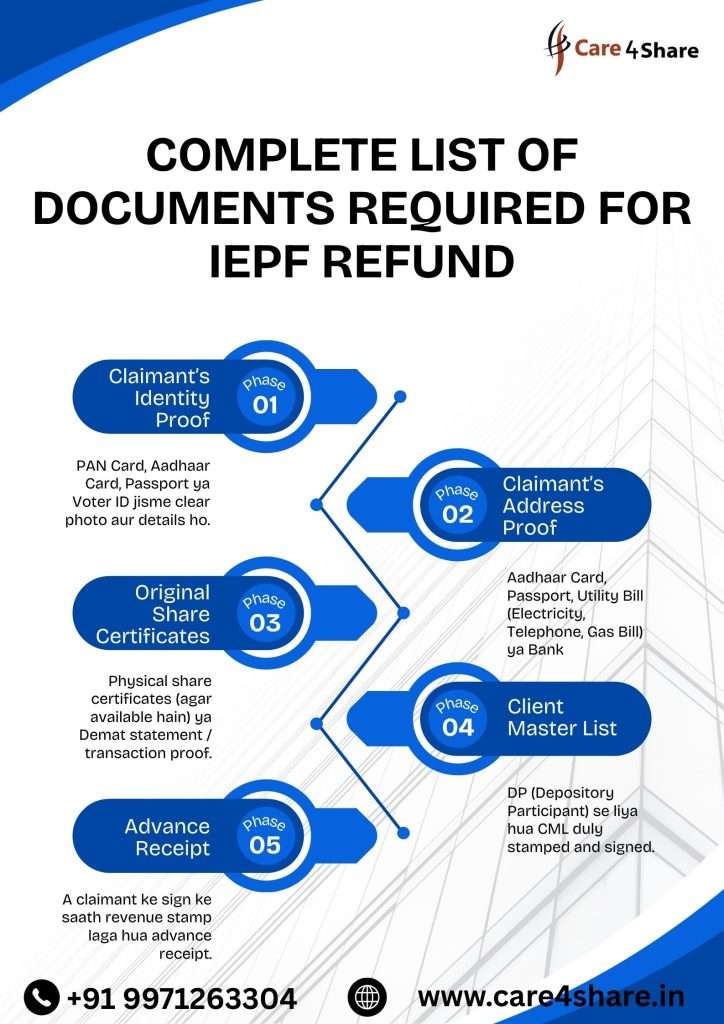

Complete List of Documents Required for IEPF Refund

1. Duly Filled Form IEPF-5

Downloadable from the MCA website.

Must be filled online and submitted with correct details of claimant, company, and shares/dividends.

2. Acknowledgement Copy of Form IEPF-5

After uploading, save the SRN (Service Request Number).

Print the acknowledgement for submission to the company’s Nodal Officer.

3. Copy of Aadhaar Card / Identity Proof

For Indian citizens: Aadhaar, Voter ID, Passport, or Driving License.

For NRI claimants: Passport and Overseas Address Proof.

4. Proof of Address

Utility bill, ration card, Aadhaar with address, or bank statement.

Must match with the details provided in IEPF-5.

5. Original Share Certificate (if physical shares)

- If shares are in Demat form, provide Client Master List (CML) from the depository (NSDL/CDSL).

6. Transaction Proof

- Dividend warrants, allotment letters, application forms, or depository statements showing ownership.

7. Demat Account Details

Claimant must have a Demat account in their own name.

A self-attested Client Master List (CML) from the depository participant is mandatory.

8. Indemnity Bond

To be executed on a non-judicial stamp paper of appropriate value.

Format available on MCA/IEPF portal.

9. Advance Receipt (Duly Signed by Claimant & Witness)

- For refund of dividend amounts, signed receipt acknowledging payment.

10. Copy of Death Certificate (in case of deceased shareholder)

- Required if claim is by legal heir/nominee/successor.

11. Succession Certificate / Probate / Will

Legal proof of entitlement if original shareholder is deceased.

Issued by a competent court.

12. PAN Card Copy

- Mandatory for tax compliance.

13. Cancelled Cheque of Claimant’s Bank Account

- For dividend refunds (amount will be credited to this account).

14. Other Company-Specific Documents

- Some companies may ask for additional papers like KYC forms, notarized affidavits, etc.

Step-by-Step Process to Claim IEPF Refund

Step 1: Gather Documents

Prepare all documents required for IEPF refund in self-attested copies. Keep originals ready for verification.

Step 2: File Form IEPF-5 Online

Visit MCA website → Services → IEPF-5.

Fill in details: claimant info, company name, CIN, shares/dividend details.

Upload necessary attachments.

Step 3: Submit to Nodal Officer

Print IEPF-5 + acknowledgement.

Send physical set of documents to the company’s Nodal Officer at its registered office.

Step 4: Verification by Company

The company verifies the documents and issues a verification report to IEPF Authority.

Step 5: Approval by IEPF Authority

After scrutiny, the IEPF Authority releases the refund:

Shares → transferred to claimant’s Demat account.

Dividend/amount → credited to claimant’s bank account.

Common Mistakes While Submitting Documents

Mismatch in claimant name across Aadhaar, PAN, and Demat.

Incomplete indemnity bond or wrong stamp paper value.

Not providing succession proof in case of deceased shareholder.

Expired or invalid documents.

Wrong bank account details in cancelled cheque.

Tips for Faster Approval of IEPF Refund

✅ Ensure all documents required for IEPF refund are self-attested.

✅ Attach an index + covering letter to Nodal Officer.

✅ Use updated formats of indemnity bond & advance receipt (available on MCA site).

✅ Follow up with the company’s Nodal Officer after submission.

✅ Track status using SRN on MCA website.

Role of Nodal Officer in Document Verification

Every company has a designated IEPF Nodal Officer who verifies documents submitted by claimants. Their report plays a crucial role in approval. Always send complete and accurate sets of documents to avoid back-and-forth delays.

FAQs on Documents Required for IEPF Refund

Q1. Can I claim without a Demat account?

No, having a Demat account is mandatory for share refund.

Q2. Is PAN mandatory?

Yes, PAN is compulsory for all claimants.

Q3. What if the shareholder is deceased?

Legal heirs/nominees must provide death certificate + succession certificate/probate/will.

Q4. How long does the refund take?

Usually 6–12 weeks, depending on document verification.

Q5. Can I file without an indemnity bond?

No, indemnity bond is a must for IEPF claims.

Conclusion

Claiming unclaimed shares or dividends through IEPF may seem complex, but with the right set of documents, the process becomes smooth. The most critical step is preparing all documents required for IEPF refund in correct formats and ensuring no mismatch in details.

By following the checklist shared in this blog and avoiding common mistakes, you can secure your rightful investment and complete the IEPF refund process successfully.