INTRO

When it comes to recovering unclaimed investments, the Investor Education and Protection Fund (IEPF) plays a critical role. Over the years, thousands of crores worth of shares, dividends, and matured deposits have been transferred to IEPF by companies due to investor inactivity. While many investors are aware of the IEPF claim process, very few understand the Public Notice Requirement in IEPF Claims—a crucial step that ensures transparency, legal compliance, and protection against fraudulent recovery attempts. This detailed guide explains why public notice is required, how it impacts claimants, and the step-by-step procedure to comply with it. Along the way, we’ll also discuss related investor concerns such as how to recover lost shares, claim old unclaimed dividends, track forgotten shares and dividends, and reclaim shares transferred to IEPF.

What is the Public Notice Requirement in IEPF Claims?

The Public Notice Requirement in IEPF Claims refers to the obligation of legal heirs, nominees, or claimants to issue a public notice in a widely circulated newspaper before recovering shares or dividends from IEPF.

This requirement arises mainly in cases where:

- Shares are claimed by legal heirs after the death of a shareholder.

- There are multiple claimants to the same set of shares or dividends.

- The company or the IEPF Authority wants to ensure no third party has a competing claim.

By publishing a public notice, the claimant announces their intention to recover shares and invites objections, if any, from other interested parties.

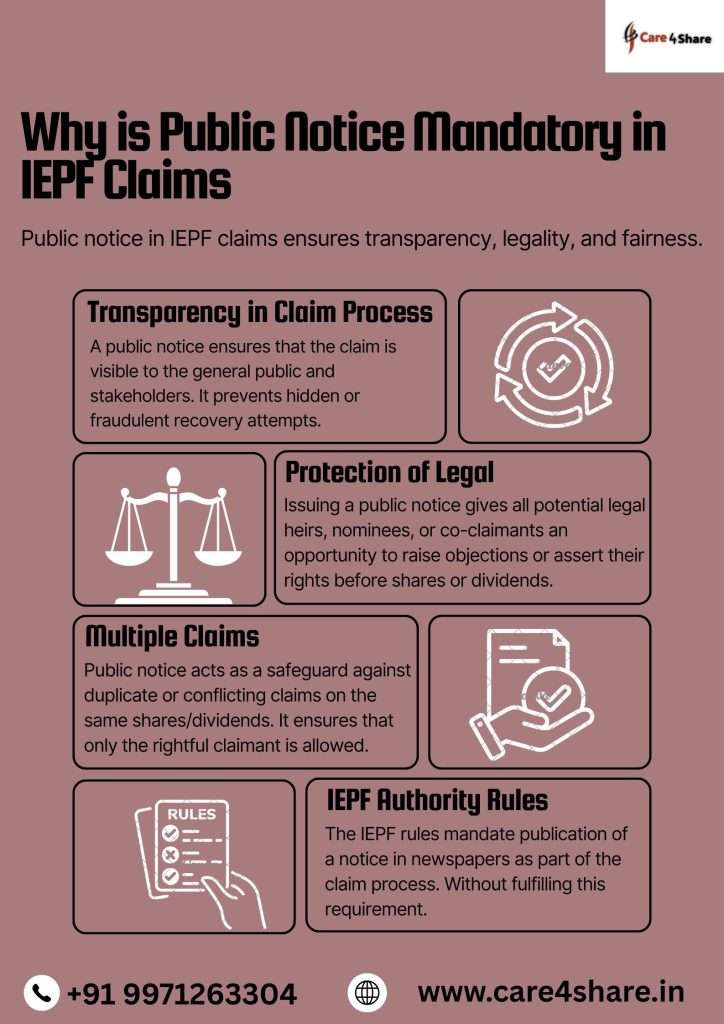

Why is Public Notice Mandatory in IEPF Claims?

The Public Notice Requirement in IEPF Claims is not just a formality—it serves multiple purposes:

- Prevents Fraudulent Claims

- Helps safeguard against imposters trying to recover shares using fake documents.

- Helps safeguard against imposters trying to recover shares using fake documents.

- Ensures Legal Transparency

- Creates a transparent trail of information accessible to the public.

- Creates a transparent trail of information accessible to the public.

- Protects Rights of Other Heirs/Claimants

- Ensures that if there are multiple heirs or disputes, objections can be raised in time.

- Ensures that if there are multiple heirs or disputes, objections can be raised in time.

- Strengthens the Validity of Claims

- A claim backed by a public notice holds greater legal weight in case of disputes.

- A claim backed by a public notice holds greater legal weight in case of disputes.

Without following this step, your claim could be rejected, delayed, or challenged in the future.

Step-by-Step Process of Public Notice in IEPF Claims

If you are claiming shares or dividends through IEPF, here’s how to comply with the Public Notice Requirement in IEPF Claims:

Step 1: Draft the Public Notice

- Prepare a clear notice including:

- Name of the deceased shareholder (if applicable).

- Name of the claimant(s).

- Details of the shares/dividends being claimed.

- Declaration that objections, if any, should be submitted within a given timeframe.

Step 2: Publish in Newspaper

- The notice must be published in at least one English and one vernacular (regional language) newspaper, both having wide circulation.

Step 3: Maintain Copies

- Keep original copies of the published notices as proof. These will be required during the IEPF claim verification process.

Step 4: Submit to Company & IEPF Authority

- Attach copies of the notice along with your IEPF claim form (Form IEPF-5) and supporting documents.

Step 5: Waiting Period

- A waiting period of 30–45 days may be applied to allow objections before the claim is processed.

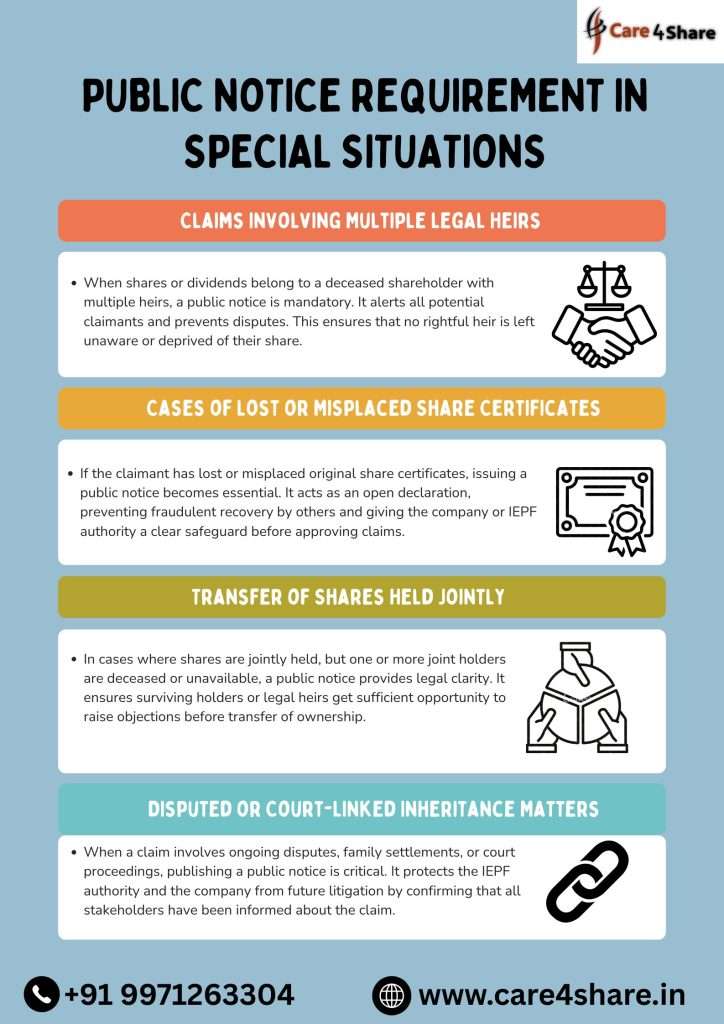

Public Notice Requirement in Special Situations

- Recovering Shares from Deceased Person’s Account

- If you are a legal heir, nominee, or successor, the Public Notice Requirement in IEPF Claims becomes essential to avoid disputes.

- Transfer of Shares to Legal Heirs

- When shares are transferred to heirs through succession certificates or probates, public notice ensures that no other hidden claim surfaces later.

- Recovering Old Physical Share Certificates

- If original certificates are lost, the notice acts as an additional safeguard before issuing duplicates and processing claims.

How Public Notice Links to Common Investor Queries

Many investors don’t realize that unclaimed shares, dividends, and matured deposits automatically move to the IEPF after seven years. Here’s how public notice fits into the bigger picture of common concerns:

- How to recover lost shares?

Public notice strengthens your recovery process, especially when duplicate certificates are required. - Claim old unclaimed dividends

Public notice assures that you are the rightful claimant of dividends that were long forgotten. - Recover shares from deceased person’s account

Mandatory in succession cases, ensuring fairness to all heirs. - Process to get back unclaimed investments

A public notice acts as proof of intent and legitimacy. - Track forgotten shares and dividends

Once traced, claims backed by public notice move faster. - Transfer of shares to legal heirs

Public notice is often required before legal heirs can consolidate ownership. - Recover old physical share certificates

Helps validate authenticity when old paper records are missing. - Claim procedure for unclaimed company dividends

Adds credibility to the claim submission. - Refund of shares from government account

Since IEPF acts as a custodian, public notice helps in smooth refunding. - Recover lost investments in India

Notice ensures your claim is secure and protected from disputes. - How to check unclaimed dividends online

After checking, a claim with public notice provides additional legal standing. - Reclaim shares transferred to IEPF

Mandatory in high-value claims to avoid fraudulent transfers. - Legal process to recover old shares

Public notice is often cited as part of compliance during court or tribunal reviews. - Help with unclaimed shares recovery

Professionals assisting investors always recommend issuing notices to avoid complications. - Claim unpaid dividends from companies

Valid claims backed by notice have fewer rejection risks.

Common Mistakes to Avoid in Public Notice for IEPF Claims

- Publishing in small or irrelevant newspapers with no wide reach.

- Missing critical details such as shareholder name, folio number, or ISIN.

- Not keeping copies of the notice as evidence.

- Skipping the step altogether, hoping the claim will pass without notice (often leads to rejection).

- Issuing notice only in English and ignoring vernacular language requirement.

Practical Tips for a Smooth Claim

- Seek Professional Help

Legal and financial experts can draft notices correctly and guide you through the claim process. - Start Early

Don’t wait until disputes arise—issue notices as soon as you begin the claim. - Keep Documentation Ready

Public notice is only one part; ensure you have death certificates, succession certificates, or other legal documents handy.

Use Digital Tools

Track forgotten shares and dividends online via company websites or MCA’s IEPF portal before issuing notices.

Final Thoughts

The Public Notice Requirement in IEPF Claims is not just a legal obligation—it’s a safeguard that protects your rights and ensures transparency in the recovery of unclaimed investments. Whether you are trying to recover shares from a deceased person’s account, claim old unclaimed dividends, or reclaim shares transferred to IEPF, following the notice procedure is essential.

In today’s world, where millions of rupees worth of lost shares, forgotten dividends, and old investments remain unclaimed, public notice acts as a bridge between rightful investors and their wealth. By understanding and complying with this step, you can make your IEPF claim stronger, faster, and more secure.